Top Cheapest Prop Firms by Mathematical Formula

Top Cheapest Prop Firms by Mathematical Formula

6/16/2024

Choosing the right prop trading firm is important for traders looking to maximize their potential while minimizing costs. With so many firms offering various benefits, finding the most cost-effective option can be daunting. In this article, we will compare the top 16 prop firms that have been in operation for at least a year and identify the top five cheapest firms using a detailed mathematical formula.

Note: All the firms in this list are the ones, that can be trusted. This list is not in the order of Trust, but is in the order of CER formula

Comparing prop firms solely on price is like comparing apples to oranges. Every prop firm has their own benefits over others. Someone might have better scaling, meanwhile others can have faster customer support. Account size, profit targets, drawdown limits, and features like copy trading all play a role in determining the overall value proposition. To address this challenge, we introduce the Cost-Effectiveness Ratio (CER) formula.

- Price (P): The upfront cost of participating in the firm's program.

- Copy Trading Bonus Percentage (CT_Bonus_Percent): A reduction in price for firms allowing copy trading.

- News Trading Bonus Percentage (NT_Bonus_Percent): A reduction in price for firms allowing news trading (partially or fully).

- Account Size (AS): The size of the trading capital provided by the firm.

- Profit Target (PT): The total percentage profit required to pass the evaluation.

- Drawdown Percentage (DP): The maximum allowable loss before the account is closed.

- Type of Drawdown(DD): Is the drawdown calculated based on Balance or Equity. (Any firm offering both Balance Based or Equity based will be considered as Equity based)

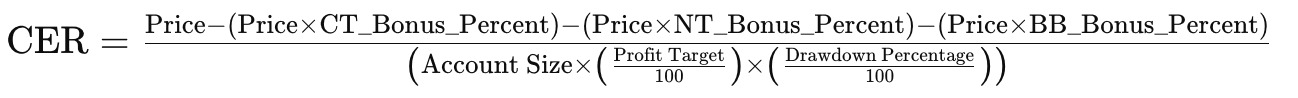

The formula is designed to rank proprietary trading firms based on their cost-effectiveness while considering several critical factors: account size, profit target, drawdown percentage, price, and the availability of copy trading and news trading features. This method ensures a comprehensive evaluation of the firms' offerings.

CER = (Price - (Price * CT_Bonus_Percent) - (Price * NT_Bonus_Percent) - (Price * BB_Bonus_Percent)) / (Account Size * (Profit Target/100) * (Drawdown Percentage/100))

Components of the Formula

- Price (P)

- What It Is: The cost of the challenge or fee to participate in the prop firm's program.

- Why It's Important: Lower prices are generally more attractive to traders, making a firm more cost-effective. This is the primary cost component of the formula.

- Copy Trading Bonus Percentage (CT_Bonus_Percent)

- What It Is: A percentage reduction applied to the price if the firm allows copy trading.

- Why It's Important: Copy trading is a valuable feature for many traders, as it allows them to copy trades between their accounts and scale up easily. The bonus incentivizes firms that offer this feature by lowering their effective price in the formula.

- News Trading Bonus Percentage (NT_Bonus_Percent)

- What It Is: A percentage reduction applied to the price if the firm allows news trading.

- Why It's Important: News trading is very helpful for swing traders. Not all traders are Day Traders. Similar to copy trading, this bonus rewards firms that permit this practice by reducing their effective price.

- Account Size (AS)

- What It Is: The size of the trading account provided by the prop firm that we will be comparing.

- Profit Target (PT)

- What It Is: The total profit target for both phases of the firm's evaluation process, expressed as a percentage.

- Why It's Important: Higher profit targets make the challenge more difficult. By including this factor, the formula accounts for the difficulty level of achieving the required profits, making firms with lower targets more attractive.

- Drawdown Percentage (DP)

- What It Is: The maximum allowable loss (as a percentage) before the account is closed.

- Why It's Important: A higher drawdown percentage gives traders more room to absorb losses, making the trading conditions more favorable. This factor ensures that firms with more lenient drawdown limits are preferred.

- Drawdown Type (DD)

- What It Is: The drawdown type offered by a prop firm. It can be either Equity Based or Balance Based.

- Why It's Important: Balance based drawdown is more favorable as it helps Swing traders. Equity based drawdown restricts traders from holding positions too long.

Here is the Data that wwe will be using in this Comparison

Adjusted Bonus Percentages

- Copy Trading Bonus Percentage (CT_Bonus_Percent): 10% for full, 5% for partial

- News Trading Bonus Percentage (NT_Bonus_Percent): 10% for full, 5% for partial

- Balance-Based Bonus Percentage (BB_Bonus_Percent): 10%

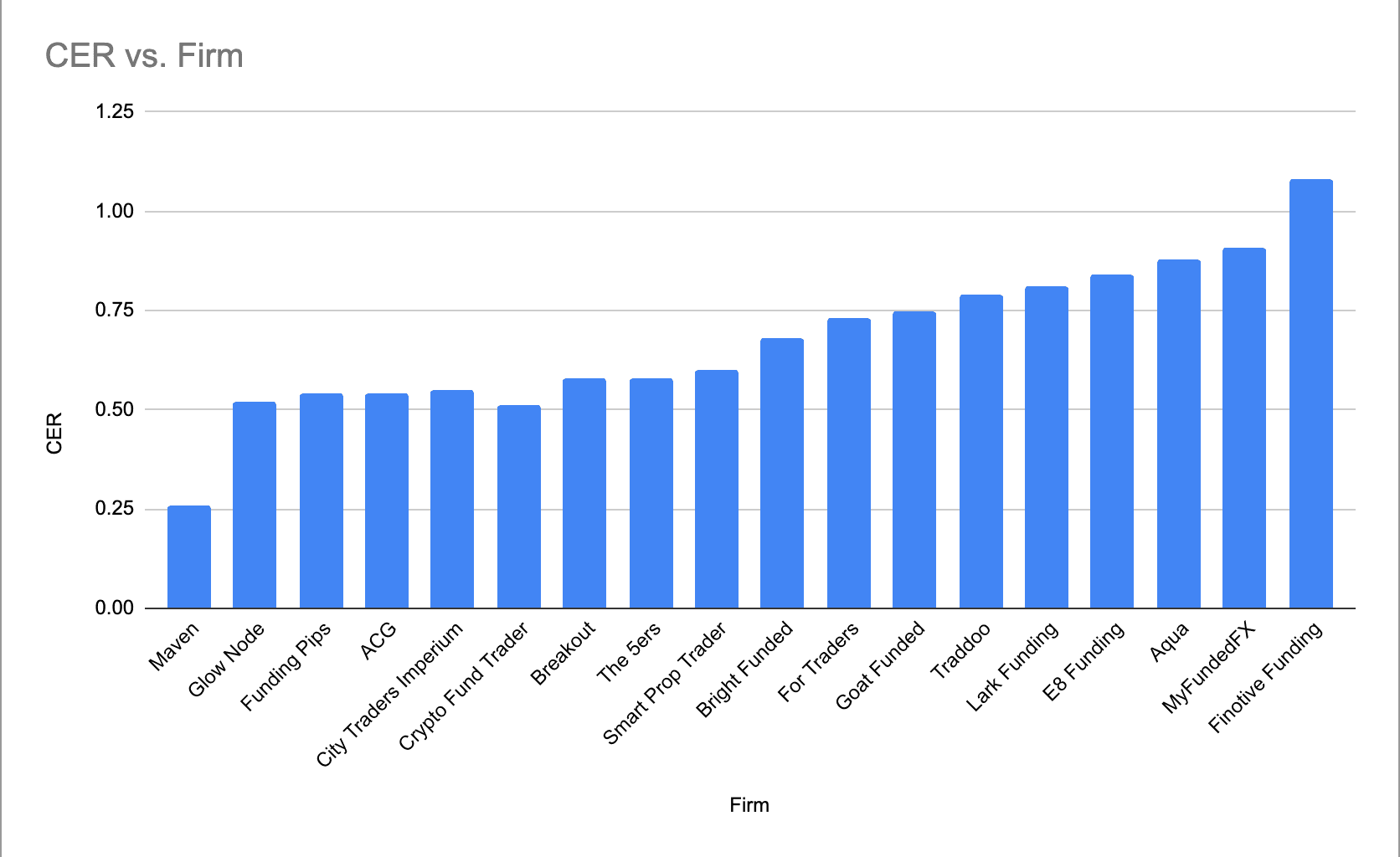

Based on the adjusted CER calculations with partial bonuses, the firms are ranked from most cost-effective to least cost-effective as follows:

- Maven: 0.26

- Glow Node: 0.52

- Funding Pips: 0.54

- ACG: 0.54

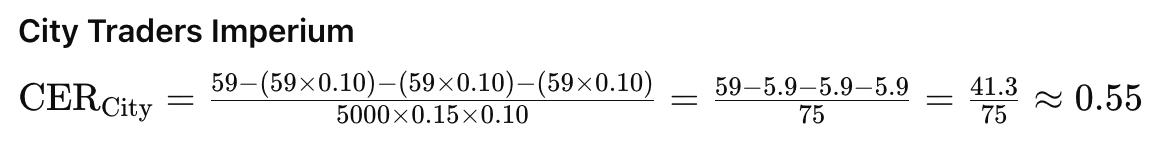

- City Traders Imperium: 0.55

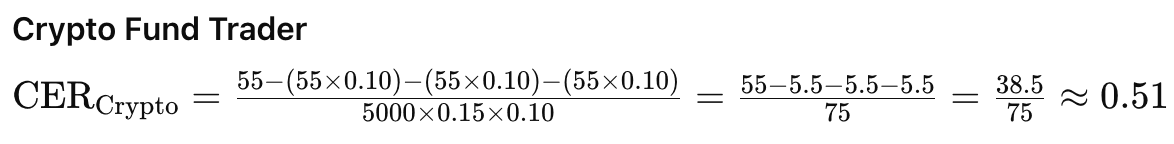

- Crypto Fund Trader: 0.51

- Breakout: 0.58

- The 5ers: 0.58

- Smart Prop Trader: 0.60

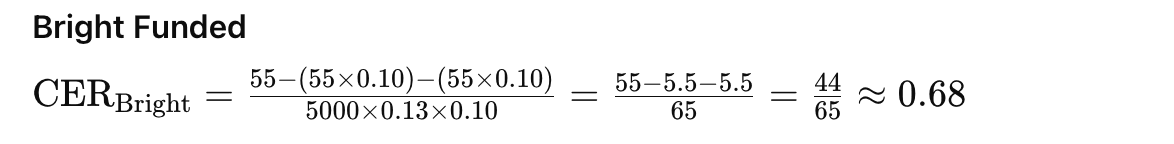

- Bright Funded: 0.68

- For Traders: 0.73

- Goat Funded: 0.75

- Traddoo: 0.79

- Lark Funding: 0.81

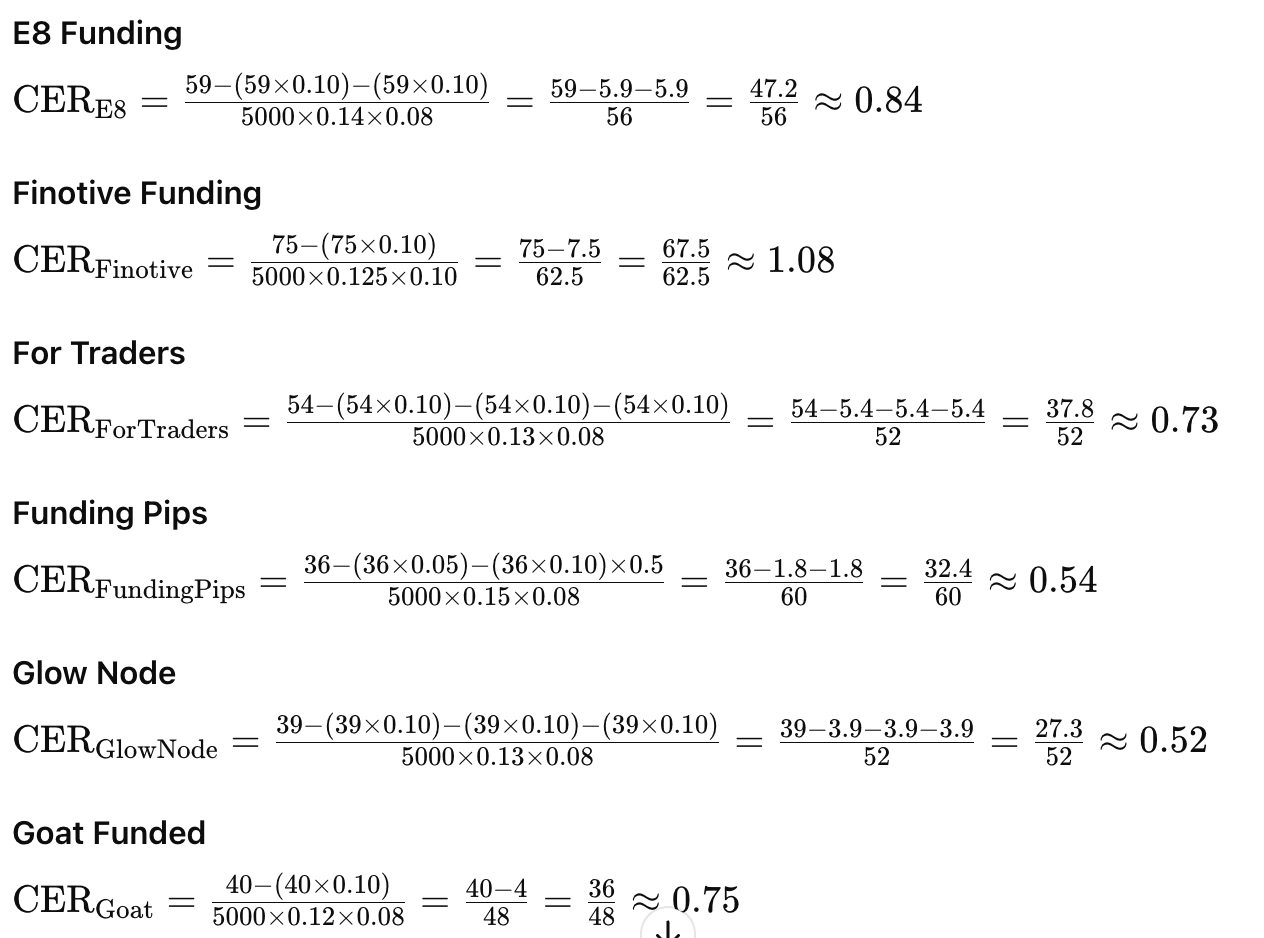

- E8 Funding: 0.84

- Aqua: 0.88

- MyFundedFX: 0.91

- Finotive Funding: 1.08

What can be improved?

1. Maven (CER = 0.26)

Why it ranked high:

- Maven has the lowest price ($19).

- Equity-based drawdown.

- Allowed copy trading.

How it can improve:

- Since it's already highly ranked, maintaining low fees and favorable trading conditions will keep it competitive. Also to consider, if we used the MatchTrader Platform. If we used cTrader platform, that CER comes to 0.7.

2. Glow Node (CER = 0.52)

Why it ranked high:

- Moderate price ($39).

- Balance-based drawdown.

- Allowed copy trading and news trading.

3. Funding Pips (CER = 0.54)

Why it ranked high:

- Low price ($36).

- Partial allowance of copy trading (Account needs to be a master account).

- Equity-based drawdown.

How it can improve:

- Allow full copy trading.

- Consider balance-based drawdown for an additional advantage.

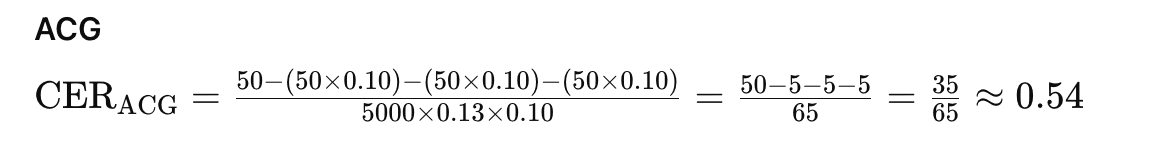

4. ACG (CER = 0.54)

Why it ranked high:

- Moderate price ($50).

- Balance-based drawdown.

- Allowed both copy trading and news trading.

How it can improve:

- Lowering the price could improve its ranking.

Middle-Ranked Firms

5. City Traders Imperium (CER = 0.55)

Why it ranked moderately high:

- Moderate price ($59).

- Balance-based drawdown.

- Allowed both copy trading and news trading.

How it can improve:

- Lowering the price could improve its ranking.

6. Crypto Fund Trader (CER = 0.51)

Why it ranked moderately high:

- Moderate price ($55).

- Balance-based drawdown.

- Allowed both copy trading and news trading.

How it can improve:

- Lowering the price could improve its ranking.

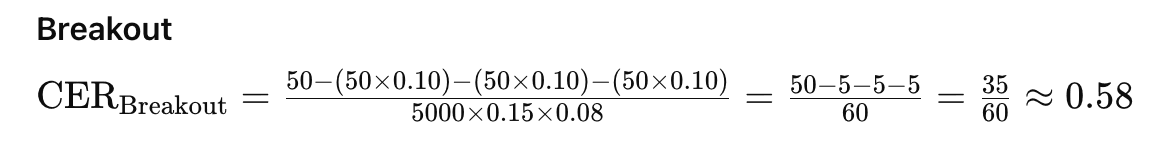

7. Breakout (CER = 0.58)

Why it ranked moderately high:

- Moderate price ($50).

- Balance-based drawdown.

- Allowed both copy trading and news trading.

How it can improve:

- Lowering the price or reducing the profit target percentage could improve its ranking.

8. The 5ers (CER = 0.58)

Why it ranked moderately high:

- Low price ($39).

- Partial allowance of news trading.

- Allows copy trading.

How it can improve:

- Consider balance-based drawdown.

9. Smart Prop Trader (CER = 0.60)

Why it ranked moderately high:

- Higher price ($67).

- Balance-based drawdown.

- Allowed both copy trading and news trading.

How it can improve:

- Lowering the price could improve its ranking.

Lower-Ranked Firms

10. Bright Funded (CER = 0.68)

Why it ranked moderately:

- Moderate price ($55).

- Balance-based drawdown.

- Allowed copy trading but not news trading.

How it can improve:

- Allow news trading/holding under certain conditions.

- Lower the price.

11. For Traders (CER = 0.73)

Why it ranked moderately:

- Moderate price ($54).

- Balance-based drawdown.

- Allowed both copy trading and news trading.

How it can improve:

- Lowering the price could improve its ranking.

12. Goat Funded (CER = 0.75)

Why it ranked lower:

- Moderate price ($40).

- Equity-based drawdown.

- Allowed copy trading but not news trading/holding.

How it can improve:

- Allow holding during news under certain conditions for swing traders.

- Consider balance-based drawdown.

13. Traddoo (CER = 0.79)

Why it ranked lower:

- Higher price ($79).

- Equity-based drawdown.

- Allowed copy trading but not news trading.

How it can improve:

- Lower the price.

- Allow holding during news under certain conditions for swing traders.

- Consider balance-based drawdown.

14. Lark Funding (CER = 0.81)

Why it ranked lower:

- Higher price ($75).

- Balance-based drawdown.

- Allowed both copy trading and news trading.

How it can improve:

- Lower the price.

15. E8 Funding (CER = 0.84)

Why it ranked lower:

- Higher price ($59).

- Equity-based drawdown.

- Allowed copy trading but not news trading.

How it can improve:

- Allow news trading under certain conditions.

- Consider balance-based drawdown.

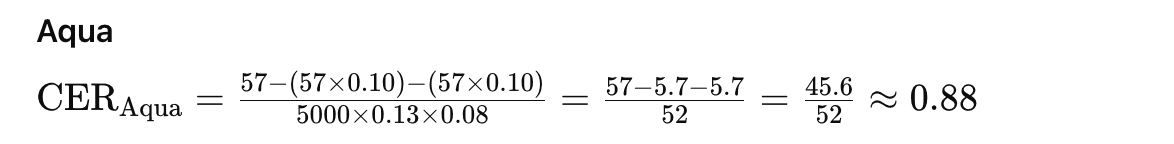

16. Aqua (CER = 0.88)

Why it ranked lower:

- Moderate price ($57).

- Equity-based drawdown.

- Allowed both copy trading and news trading.

How it can improve:

- Consider balance-based drawdown.

- Lower the price.

17. MyFundedFX (CER = 0.91)

Why it ranked lower:

- Moderate price ($50).

- Partial allowance of news trading.

18. Finotive Funding (CER = 1.08)

Why it ranked lowest:

- Higher price ($75).

- Balance-based drawdown.

- Does not allow News Trading/Holding during news.

How it can improve:

- Lower the price.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

No FAQs are available for this topic yet.