TopStep Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full TopStep review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

0.0

0.0

TopStep

Futures

US

CEO: Michael Patak

We have not evaluated this firm yet.

Ninjatrader

QuantTower

Tradovate

R Trader Pro

Wire Transfer/ Bank Transfer

Wise

PayPal

Credit/Debit Card

Topstep is a futures prop firm based in Chicago and operating through the legal entity TopstepTrader, LLC, providing simulated and instant funded accounts to traders that prefer the regulated environment of the CME Group. In 2026, Topstep is still focusing on becoming one of the leading futures prop firms for disciplined traders by giving a simplified 1-step Trading Combine, the possibility to take home 100% of the first profits and a professional grade environment for traders going through the Topstep forex to futures program.

However, the prop firm maintains strict control over the trading boundaries by Topstep daily loss limit rules and a consistency target that guarantees a single day will not be more than 40% of total gains. Besides that, traders have to handle the change from end-of-day drawdown in the evaluation to a real time "Maximum Loss Limit" after being funded. This analysis explains the Topstep trading combine criteria and payout structures to make it easier for you to decide whether this firm matches your strategy.

In this is Topstep prop firm review 2026, we analyze its Topstep payout rules, risk limits and account structures, helping traders to make up their minds as to whether this Topstep futures prop firm suits their particular trading style and risk tolerance.

Topstep Prop Firm Overview

The details below include information released directly from the website and a collection of trader feedback and the firms public disclosures as of 2026.

| Category | Details |

|---|---|

| Company Name | The prop firm name is Topstep. |

| Legal Name | Topstep's legal name is TopstepTrader, LLC. |

| Registration Number | Topstep is a registered LLC in the State of Illinois. |

| CEO | The CEO of Topstep is Michael Patak (Founder). |

| Headquarters | The headquarters is located at Chicago, USA. |

| Broker | The brokers associated with Topstep include TopstepX, NinjaTrader, Tradovate, Quantower, other Rithmic-based platforms and Plus500 for Live Funded Accounts. |

| Operating Since | Topstep has been operating since 2012. |

| Account Sizes | Topstep provides account sizes ranging from $50K, $100K and $150K. |

| Challenge Types | Topstep offers the Standard Path, No Activation Fee Path, Express Funnded Account and Live Funded Account. |

| Payout Cycle | Topstep offers 5 winning days for Express Funnded Account and Live Funded Account. |

| Payout Method | The withdrawal methods supported by Topstep are Bank Wire, Wise and ACH (via Rise). |

| Trading Platforms | Topstep supports trading on Tradovate, NinjaTrader, Quantower, and TSTrader. |

| Financial Markets | Topstep supports trading in CME Group Futures (Equity, Interest Rate, Currency and Commodity). |

| Max Allocation | Topstep offers a maximum allocation of up to 5 Express Funded Accounts per trader. |

| Max Scaling | Topstep provides scaling opportunities based on the specific account size's contract limit. |

| Trustpilot Score | Topstep has a 3.6/5 rating (as of Feb 2026) based on over 13,264 reviews. |

Pros and Cons of Trading with Topstep

Futures prop trading one's account through a firm means to consider the advantages of professional exchange access versus the inflexible nature of regulated market rules. Topstep has simplified their offer in 2026 to a quicker 1-step to 2-step funding mode.

| Pros | Cons |

|---|---|

| Operating for over a decade, proving Topstep is a legit futures prop firm in 2026. | The Topstep daily loss limit rules are hard-coded - breaching them results in immediate account deactivation. |

| Topstep payout rules explained for funded traders allow for requests after just 5 winning days of $200 or more. | Only offers Futures - traders looking for Stocks or CFD Forex will not find them here. |

| The Topstep trading combine parameters involve a 1-step process with no minimum trading days to pass. | The Topstep consistency target prevents "windfall" profits from counting toward a payout if they exceed 50% of total gains. |

| Excellent resources for those moving from Topstep forex to futures - providing a professional environment. | While the Combine includes platform access - some Live Funded Account configurations may involve data fees. |

Topstep creates an excellent learning environment for traders, however, the inflexible nature of the rules which do not allow trading through high impact news or overnight can be a problem for swing traders.

Topstep Account Types, Fees & Profit Split Explained (2026)

Understanding account structure is critical, as fees, drawdown type and profit targets directly impact long-term profitability. Topstep utilizes a subscription-based model for their evaluation phase.

Topstep Account Comparison Table

The following table provides a technical breakdown of the available funding programs by the Topstep prop firm. This data is designed to assist traders in comparing the structural differences between the Standard Path and No Activation Fee Path (evaluation phase) which helps them to move forward to Express Funded Account and eventually to the Live Funded Account.

| Feature | Trading Combine (Standard Path / No Activation Fee Path) | Express Funded Account | Live Funded Account |

| Account Sizes | $50K, $100K, $150K | $50K, $100K, $150K (Combine Size) | $50K to $150K+ |

| Account Fees | $49 / $99 / $149 | $129 Activation Fee | CME Exchange Data Fees: $133/month per exchange (Covered by Topstep) |

| Profit Target | 6% of Account Size | None | None (Payout Eligibility) |

| Daily Loss Limit | 2% | 2% (Same as Combine) | 4% / 3% / 3% (Dynamic Risk Expansion) |

| Max Drawdown | 4% / 3% / 3% | 4% / 3% / 3% (Same as Combine) | Fixed at $0 Floor |

| Drawdown Type | End-of-Day (EOD) | End-of-Day (EOD), Enforced Intraday | Enforced Intraday (Real-time) |

| Min Trading Days | 2 Days | Must have at least one trade every 30 days to keep account active | Need 10 Active Trading Days in each tier before Daily Loss Limit increases with Dynamic Risk Expansion |

| Max Trading Days | Unlimited | Unlimited | Unlimited |

| Leverage | Up to 15 Contracts | Up to 15 Contracts (Based on Scaling Plan) | Higher via Risk Team |

| Consistency Rule | 50% Best Day Rule | No (Objective Only) | No |

| Profit Split | N/A | 90/10 (First $10K 100%) | 90/10 (First $10K 100%) |

| Payout Frequency | N/A | Every 5 Winning Days | Every 5 Winning Days |

Remember that Topstep also regularly provides challenge fee discount coupons to aid traders in saving the initial capital outlay.

Below is a detailed breakdown of how the Topstep funding model works and how traders can trade on the Topstep Live Funded Account.

Topstep Account Type Breakdown

Trading Combine includes (Standard Path and No Activation Fee Path which requires hitting a specific profit target (6%) while maintaining daily loss limit and maximum drawdown rules. Whether you choose the Standard Path or the No Activation Fee Path, this target proves your ability to generate consistent returns within the Topstep trading combine account before moving to a Topstep Express Funded Account, followed by Live Funded Account.

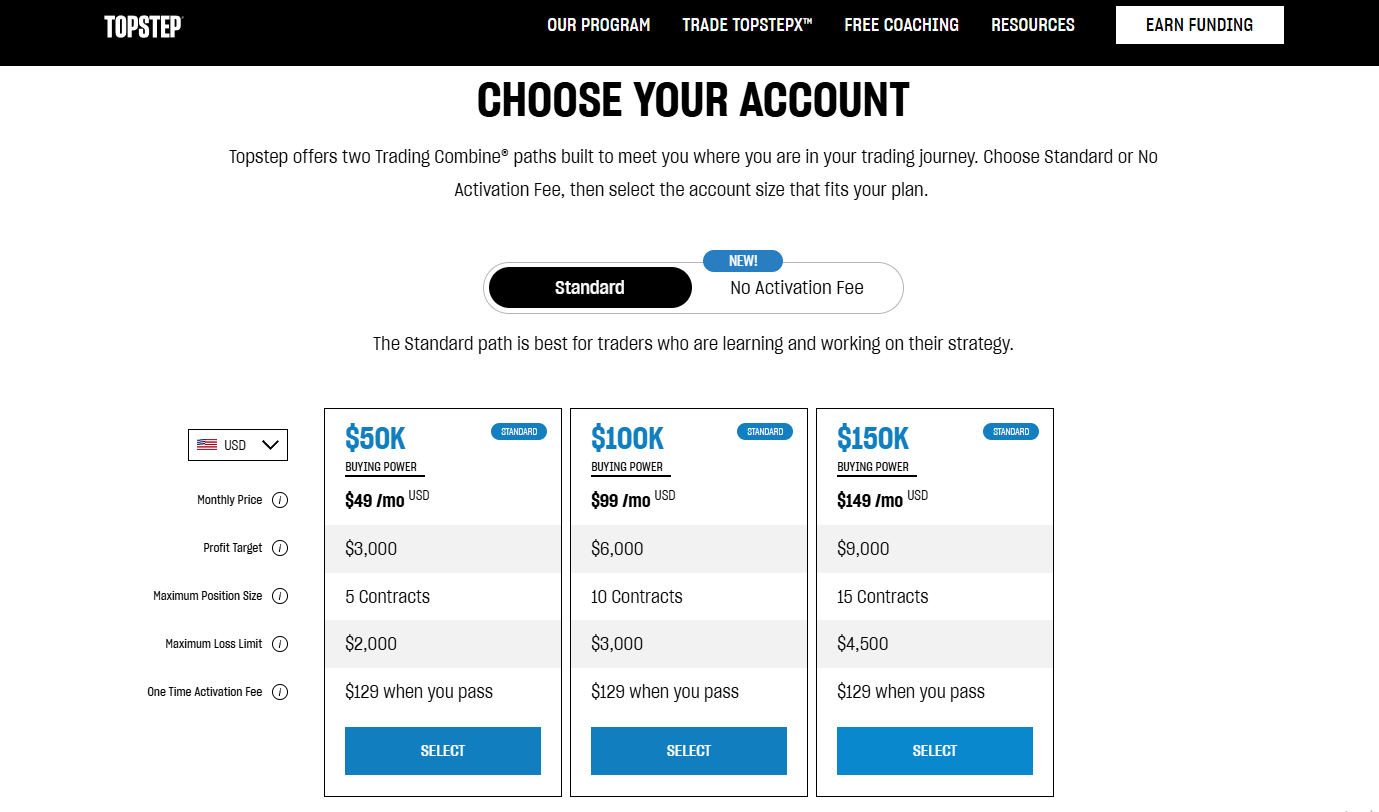

Topstep Standard Path Account Type

The Topstep Standard Path is basically a challenge model that allows futures traders to.

One of the main benefits is an EOD drawdown type that only tracks your balance at the end of the trading day rather than all the time. However, a big risk that Topstep imposes on you is that you have to strictly follow the daily loss limit and the consistency rules or else your account will be terminated.

| Account Size | Account Fee (Original Price) | Profit Target (6%) | Max Daily Drawdown (2%) | Max Total Drawdown |

| $50,000 | $49 | $3,000 | $1,000 | $2,000 (4%) |

| $100,000 | $99 | $6,000 | $2,000 | $3,000 (3%) |

| $150,000 | $149 | $9,000 | $3,000 | $4,500 (3%) |

Why Choose Topstep Standard Path Account Type?

The Standard Path caters to the trader with an iron discipline who first want to demonstrate their skills on a world class trading platform before getting funded with a real account.

- End-of-Day Drawdown Flexibility: Unlike other models, this one at least gives you intraday trades more room to breathe by the account limit only resetting based on your completed daily balance.

- 100% Initial Payout: A trader who manages to graduate from the evaluation is entitled to keep 100% of the first $10,000 in profits, thus, there is a great motivation for successful traders.

- Consistency-Based Traders: If you are a trader based on consistency then this is your perfect account because it is designed to reward those who follow the 50% best day rule and also manage their risk in a systematic way.

Topstep No Activation Fee Path Account Type

The Topstep No Activation Fee Path is essentially an advanced evaluation model for traders who have a strategy that they are confident in and basically want to keep their funding costs to a minimum. The main benefit of this path is that once you complete the Trading Combine, the standard activation fee of $129 is totally give up, you can easily continue to a funded account without incurring any cost. The work is paying a higher monthly subscription fee upfront which is more than the Standard Path, hence if you needed more than a couple of months or resets to hit the profit target, this would financially disadvantage you.

| Account Size | Account Fee (Original Price) | Profit Target (6%) | Max Daily Drawdown (2%) | Max Total Drawdown |

|---|---|---|---|---|

| $50,000 | $89 | $3,000 | $1,000 | $2,000 (4%) |

| $100,000 | $139 | $6,000 | $2,000 | $3,000 (3%) |

| $150,000 | $189 | $9,000 | $3,000 | $4,500 (3%) |

Why Choose Topstep No Activation Fee Path Account Type?

The No Activation Fee Path is the quickest way for "dialed-in" traders to get the most capital retention while getting professional funding.

- Zero Post-Pass Costs: Cut out the $129 activation fee altogether so that the only cost you will have is the evaluation subscription that you pass.

- Fast Funding Transition: You can directly transfer from the Trading Combine to an Express Funded account once you hit your target without any delay in payment.

- Consistency-Based Traders: This plan best suits consistency, based traders who are able to reach targets in 1 or 2 attempts and get the most out of the initial higher fee.

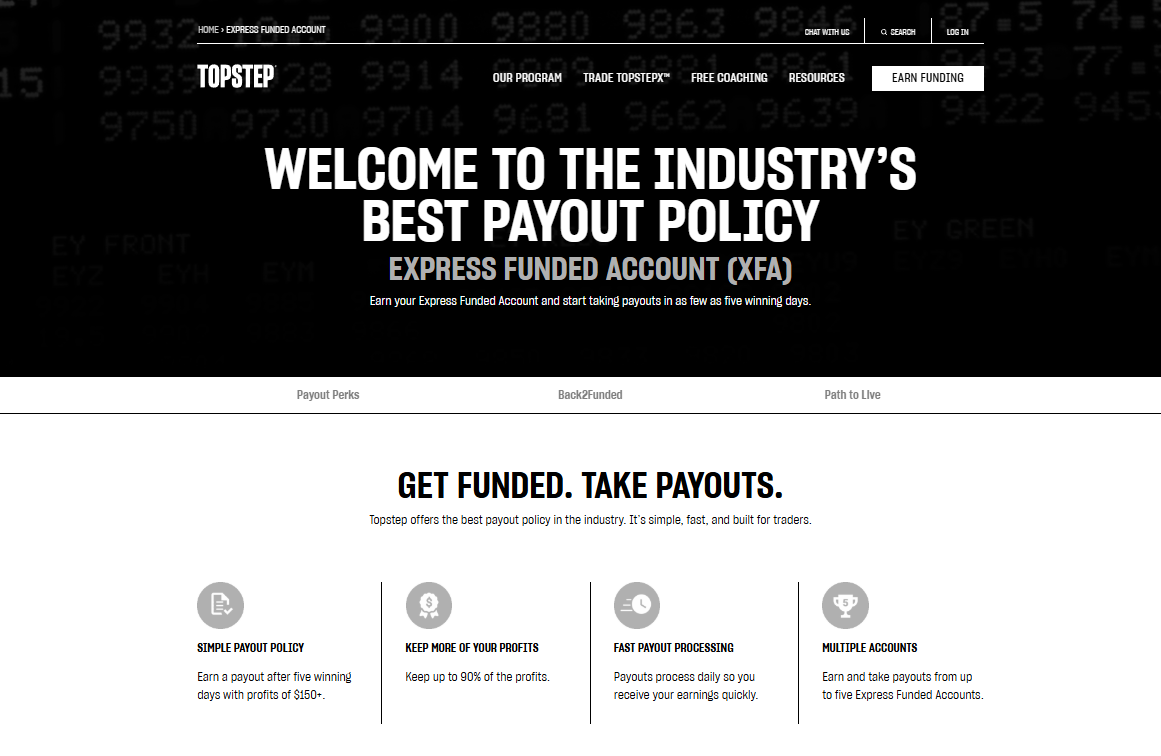

Topstep Express Funded Account

The Topstep Express Funded Account is the connecting point between the simulated environment (trading combine and the live Funded account) where traders have real profit potential after passing the Trading Combine (Standard or No Activation Fee - Evaluation Path). In this account, traders experience a professional grade trading environment with large capital access to trade in the futures market.

One major benefit is that traders joining Topstep prop firm in 2026 can enjoy 90% profit split on all payouts. Traders who joined before 12th January 2026, can take out 100% of the initial $10,000 in profits (for the legacy dashboard users) then after enjoy a 90% profit share. The main concern is the Maximum Loss Limit, which is always in effect and your account can be closed if your balance goes below the defined level. There is no profit target any longer in this stage as in the evaluation phase but traders must use the Scaling Plan that establishes the number of contracts depending on the current equity to guarantee consistent growth.

| Account Size | Account Fee (Activation) | Max Daily Drawdown (2%) | Max Total Drawdown |

|---|---|---|---|

| $50,000 | $129 | $1,000 | $2,000 (4%) |

| $100,000 | $129 | $2,000 | $3,000 (3%) |

| $150,000 | $129 | $3,000 | $4,500 (3%) |

Why Choose Topstep Express Funded Account?

The Express Funded Account is the quickest path for converting the virtual success into real earnings without shelling out live exchange data fees right away.

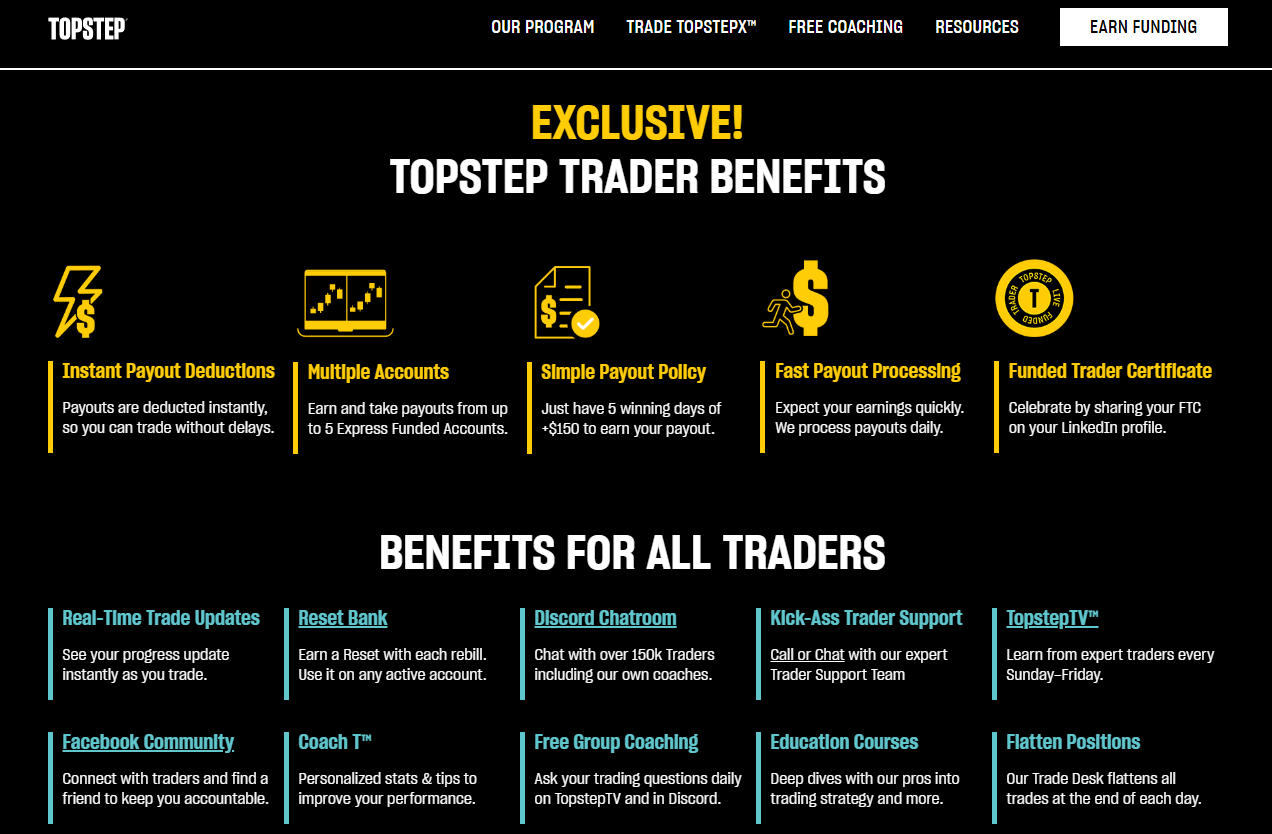

- Speedy Payout Route with your initial withdrawal request being after just five "Benchmark" winning days with $150 profit or more.

- Manage up to 5 Express Funded Accounts at once to diversify your risk and maximize your total payout potential.

- Consistency-Based Traders such an account is most suitable for consistency-based traders who follow the Scaling Plan to increase their leverage step by step as their account "buffer" gets larger.

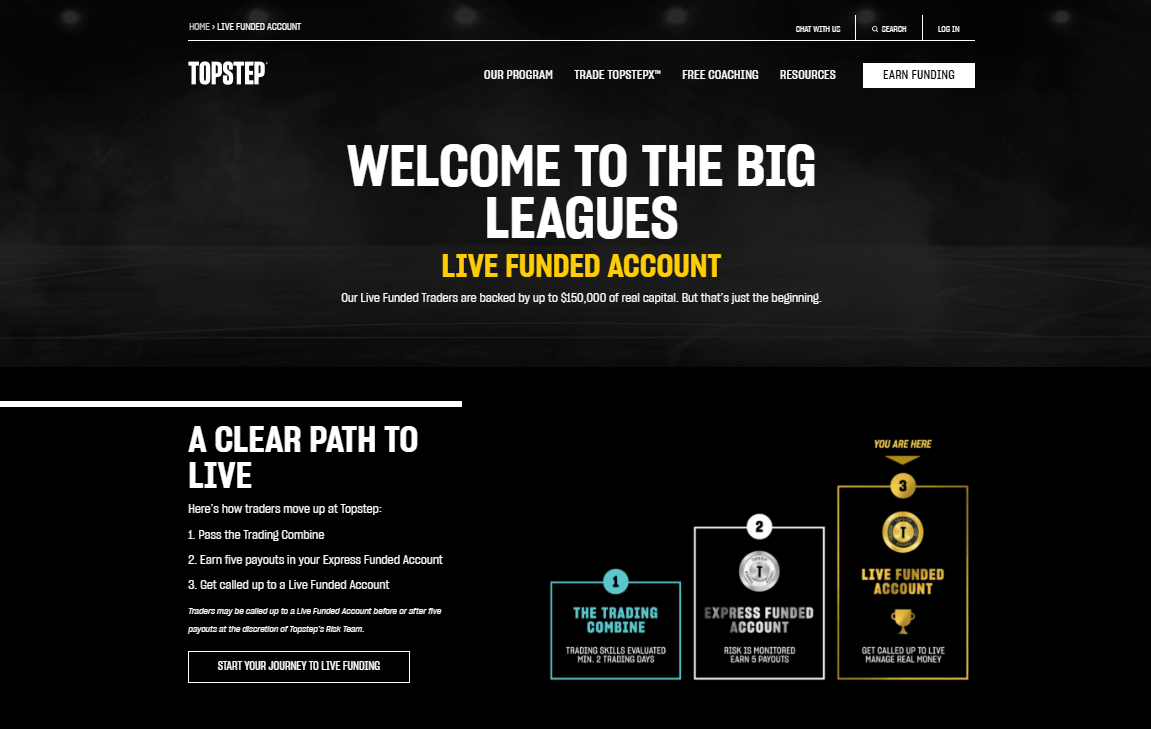

Topstep Live Funded Account

Once traders fulfill the payout requirements in express funded account, they move towards the Topstep Live Funded Account - the last professional level for futures traders benefiting from trading with large funded capital in the live futures market. One of the major benefit of this account is Dynamic Risk Expansion, which increases your Daily Loss Limit as you show consistent trading over several days. A significant risk is the Enforced Intraday Drawdown which means your losses are tracked in real-time as they happen, rather than at the end of the day. In the Live Funded Account you must manage your trades more carefully to avoid breaching the account. Below are the details of account size, daily and total drawdown of Topstep Live Funded Account.

| Account Size | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|

| $50,000 | $2,000 (4%) | Fixed at $0 Floor |

| $100,000 | $3,000 (3%) | Fixed at $0 Floor |

| $150,000 | $4,500 (3%) | Fixed at $0 Floor |

The Live Funded Account by the Topstep prop firm is the dream funded account for professional traders, if they want to pursue a long-term career in the futures market and take advantage of the firm’s institutional level capital and trader support.

- Fixed Total Drawdown: When your account balance reaches the initial "zero" level, the fixed total drawdown will no longer be trailing, allowing you to have a bit more room to grow.

- Payout Eligibility: Hitting the 5 winning day mark will allow you to fully access payout requests and make cash flow instantly available to you.

- Consistency-Based Traders: This account is tailored for consistency focused traders who can control their intraday risk effectively and at the same time they are able to gradually increase their daily loss limits through the Dynamic Risk Expansion levels.

Our Verdict on Topstep Account Types

Based on our research, the Topstep account structure is designed for wide range of trading styles, which professional futures market access through its flexible Trading Combine paths and funded stages. In our analysis, the Topstep Trading Combine account type has two evaluation path which are Standard and No Activation Fee, they are provided with an institutional-grade environment that rewards disciplined, consistency-based performance of traders. The transition from the simulated Express Funded Account to the Live Funded Account stage allows for professional growth, supported by unique features like Dynamic Risk Expansion and a static "zero floor" drawdown once established. Ultimately, Topstep stands as a premier choice for serious traders who value clear and transparent rules, reliable payouts and those who want long-term career success in the futures market.

Topstep Drawdown and News Trading Rules

Before you can be eligible for funding and keep that status, you need to understand how Topstep's daily loss limit rules and drawdown mechanics work. To traders, Topstep uses a trailing drawdown system and once a trader gets funded, this changes to a "Maximum Loss Limit".

Drawdown Details:

Topstep has an intraday Maximum Loss Limit that accounts cannot go over. If an account withdraws to that level, including open equity, it will be locked out. Different from many brokers that use an end-of-day drawdown, Topstep real-time calculation allows less room for error. By 2026, the Topstep daily loss limit and consistency rule will be inseparable - traders must ensure that the profit from any single day does not exceed 40% of their total gains if they are to meet the Topstep consistency target.

Numeric Example:

| Day | Start Balance | Daily Peak | End-of-Day Balance | Max Loss Limit (Floor) | Result |

|---|---|---|---|---|---|

| 1 | $50,000 | $51,000 | $50,500 | $48,500 | Floor trails to $50,500 - $2,000. |

| 2 | $50,500 | $50,800 | $50,200 | $48,500 | Balance dropped, but Floor stays at $48,500. |

| 3 | $50,200 | $52,500 | $52,100 | $50,000 | Floor hits $50k and stops trailing forever. |

News Trading Details:

The firm allows trading during news events as long as traders adhere to the Topstep combine rules that are in their handbook. Although they do not prohibit news trading in the Trading Combine, they warn that extreme volatility can cause slippage which might result in a violation of the Daily Loss Limit. To get an idea of how Topstep accommodates news trading, based on the example of a NFP announcement, here is how a trader's interaction with the news could be:

- The Setup: Just prior to 8:30 AM ET, a trader is holding a "Long" position on the E-mini S&P 500 (ES).

- The Volatility: The announcement comes out and the market drastically changes as it becomes very "thin" (liquidity is very low). The price is changed by 20 points very rapidly.

- The Slippage Risk: There is a stop, loss order placed 5 points away from the trader's current position. But, since the market "gaps" beyond that price level due to the news volatility, the stop order is executed 15 points away from the original signal.

- The Outcome: If the extra slippage incurred has led to the violation of the Topstep daily loss limit, then the trader's account is terminated immediately. Topstep won't grant over-do traders for news related slippage, as this is recognized to be one of the normal risks of the live futures market.

Topstep's risk management is designed to support professional traders' careers over the long term by setting an End-of-Day Max Loss Limit, which eliminates the danger of constantly chasing and losing peaks in intraday profits and offers a fixed base whenever the initial amount is achieved.

Though the prop firm allows news trading, it still has a "performance-first" mentality where traders are expected to handle the major market volatility of the news events without Topstep daily loss limit rules getting infringed. These regulations by their very nature favor rote and steady strategy execution over high-stakes gambling that usually payoffs are the upshots of a repeatable, consistent strategy rather than the result of a single market spike.

Trading Instruments Offered by Topstep

The Topstep futures trading program is mainly geared toward the CME Group exchanges, making it an ideal pick for those changing from the Topstep forex to futures program. Such a concentration guarantees all the participants have access to highly liquid and regulated price feeds.

Trading Instruments Details:

The traders can trade a variety of futures contracts that are listed in the four major exchanges:

- CME, CBOT, NYMEX and COMEX.

- Among the Equity Futures (E-mini and Micro S&P 500, Nasdaq 100).

- Foreign Exchange Futures (Euro FX, British Pound).

- Energy Futures (Crude Oil, Natural Gas).

- Agricultural/Metal Futures (Gold, Silver, Corn) are a few examples.

Topstep traders are given the professional privilege of trading, the firm creates a regulated setting with profound liquidity, so whatever your trading style is, whether you are scalping the Nasdaq or trading interest rate futures, you can rely on institutional grade tools to accomplish success.

Topstep Spreads & Commissions: What You Really Pay

When wondering how does Topstep trading combine work in 2026 in terms of costs, a trader should not only consider the monthly subscription fee. Since Topstep offers the opportunity to trade CME Group products, traders are hit with professional grade execution costs reflecting live market conditions.

Spreads and Commissions Details:

Topstep traders are charged standard exchange execution fees and commissions that change depending on the platform (for instance, Tradovate or TSTrader). A case in point is the E-mini S&P 500 (ES) commissions that generally range from $0.50 to $2.00 per side, depending on the platform and contract type (Micro vs Standard).

The expenses are instantly deducted from the account equity, it is crucial for traders to include the idea of "cost of doing business" when determining their net profit for the funding target.

Topstep Trading Rules (2026): What is Allowed and What is Not

It is crucial to have a thorough knowledge of the risk management framework, which is aimed at developing professional habits, when one desires to Topstep trading combine parameters. Being a leading Topstep futures prop firm, the site implements several mechanical rules like the daily loss limit rules and the consistency target that help traders to control the capital properly even before the step up to the funded environment.

| Trading Strategy | Allowed? | Details |

| Scalping | Yes | Fully supported; traders can take advantage of small price movements with high frequency. |

| Day Trading | Yes | The core intended style for Topstep. All positions must be closed before the market close. |

| News Trading | Yes | Permitted, but traders are responsible for slippage and must avoid "gambling" behavior. |

| Trend Following | Yes | Supported for intraday moves using technical indicators or price action. |

| Price Action Trading | Yes | Encouraged; standard retail strategies like support/resistance are fully compatible. |

| Automated / EA Trading | Yes | Permitted as long as it is a retail-grade strategy and not a prohibited HFT/latency bot. |

| Swing Trading | No | All positions must be flattened by the end of the trading session (no overnight holding). |

| Hedging | No | Holding "Long" and "Short" positions in the same instrument simultaneously is not allowed. |

| Arbing / Latency Arbitrage | No | Exploiting data feed delays or platform latencies is a strictly prohibited hard breach. |

| HFT (High-Frequency Trading) | No | Institutional-grade high-frequency algorithms that execute hundreds of trades per second are banned. |

| Account Masking / Copying | No | Using software to copy trades from a "Master" account to multiple Topstep accounts is restricted. |

Main Trading Practices that are Prohibited:

- Going over the Daily Loss Limit: If your account equity is depleted to the extent of predefined daily loss limit according to your account size, you are not allowed to open any more trade positions for the rest of the day.

- Trading During Prohibited Times: Most importantly, this refers to positions held after 3:10 PM CT or the last trade opened at that time and trading outside of permitted holiday hours.

- Consistency Rule Violations: In 2026, Topstep is still strongly urging traders that no store trading day should be responsible for more than 40% of your total profit in the Trading Combine.

- Going over Maximum Position Size: By entering more contracts than your current account tier allows, you are not only breaking the rules but the platform is also monitoring your every move.

- Account Sharing: Your Topstep account should only be used by you. Trading for another person, giving the account to someone else or "signal following" services where a master account executes for a number of Topstep users is a breach of the rules and results in immediate termination.

- IP Address Policy: You are allowed to trade from different locations but if two different IP addresses simultaneously login to your account then this will be flagged by Topstep's security system. If you are going to be traveling and are going to trade then it is a good idea if you contact the support first so that the automated fraud triggers are avoided.

Soft Breach vs Hard Breach Example

Knowing the difference between a warning and an account closure is essential if you want to continue trading at Topstep.

- Hard Breach (Account Termination): A hard breach occurs when the trader breaks the Topstep daily loss limit rules or the Maximum Loss Limit.

- Example: Let's say you are trading NQ and a rapid market drop causes your daily loss to be $1,100 while the limit is $1,000. In this case, the platform automatically closes your position and the account is considered to be failed.

- Soft Breach (Rule Violation/Warning): Topstep has for the most part ceased to use "soft breaches" and instead, they implement automated hard stops. However, if there are very minor administrative issues such as attempting to trade a forbidden instrument the platform will just reject the order without failing the account.

Our Verdict on Topstep Rules

After thoroughly analyzing the Topstep trading combine parameters, we believe that they are among the most transparent ones in the industry. The rules are not a bait for traders, but rather, they are a means of enforcing the discipline necessary for professional futures trading. It can be quite annoying to comply with the Topstep consistency target (the 40% rule) during a major market move, but in the long run it safeguards the trader from the harm that comes with "revenge trading" or excessive leverage. These regulations present a professional environment that rewards the patient and strategic over the lucky ones to the serious intraday trader.

Scaling Plan at Topstep

Topstep's futures trading program features a scaling plan that gradually helps traders to move from the Topstep trading combine environment to trading in the real live market. This plan aims to protect the firm's capital while still giving traders that are doing well the possibility to increase their profit potential as their account grows. A big part of the answer to how does Topstep trading combine work in 2026? is via understanding this gradual way of increasing leverage.

Topstep Scaling Plan Details:

- The number of contracts based on tiers: Traders initially get only a few contracts, e.g. 25 lots depending on whether the account size is $50k, $100k or $150k.

- Expansion based on profits: The higher your "Realized Account Balance" the more the system will allow you to trade additional contracts.

- Lowering the risk: When the account balance goes down then the permitted contract size will be lowered accordingly to avoid exceeding the Maximum Drawdown.

- XFA integration: The scaling plan is still being a major part of the Topstep express funded account which ensuring a smooth transition for those moving from forex to futures.

The Trusted Props neutral, trust-first positioning is strengthened by this structured scaling plan operates as a merit-based system, rewarding proven performance with gradual capital increases rather than arbitrary growth. At the same time it serves as a filter for serious professionals and discourages the very high risk gambling approach that is explicitly prohibited under the Moneta Funded rules.

The Topstep scaling plan lays out a systematic road for traders to grow their contract sizes as their account balances increase, with risk being kept in line with equity. While other prop firms might offer max leverage right away, Topstep scaling plan is based on performance, rewards traders with backed accounts that steadily grow and trading consistency over the long run. This is a very good model for traders who are disciplined and want to make a career as a professional by gradually increasing their trading positions only after they have demonstrated that they can be profitable at lower risk levels.

Payment Methods and Payout Process at Topstep

For many, the ultimate question is is Topstep a legit futures prop firm in 2026? The answer is in their open and effective Topstep payout rules. The prop firm has a very simple process for both the Topstep express funded vs live funded account, so that traders who make money can get their profits in a safe and secure manner.

Payment Methods Supported:

- Credit/Debit Cards: Major providers such as (Visa, Mastercard, AMEX) are accepted for Trading Combine subscriptions.

- PayPal: Monthly membership fee payments can be made via PayPal in most countries.

- Bank Wire: Mainly done for large money transfers and funded account setup.

Payout Options Supported:

- Bank Wire: A direct transfer to your bank account, be it personal or business.

Deel: Topstep has a partnership with Deel which allows traders to withdraw their earnings using Wise, Coinbase and PayPal among other methods. This is very helpful especially for international traders.

How the Payout Process Works:

- Eligibility: No payout can be made a trader who has not first attained 5 winning days (days that show a net gain of $200 or more) since they last cashed out.

- Request Window: Applications for paying out money are handled through the Topstep dashboard. Once the request has been made then the firm usually checks and permits it within 12 working days.

- Profit Split: 100% of their first $5,000 to $10,000 in profits (depending on the promotion that is going on) is what the traders get to keep, after which the profit sharing changes to 90/10 in favor of the trader.

- Account Impact: It is important to note that the Maximum Drawdown often locks at the starting balance once a payout is processed, which is a critical detail in the Topstep payout rules explained for funded traders.

Our Verdict On Topstep Payout Process & Payment Methods

Topstep payout process has become the industry standard for reliability, strongly supporting a "trust-first" model with its traders. The prop firm values its traders highly by initially allowing 100% of the first $10,000 in profits and a 90% split for the rest. The stipulation of five winning days between requests helps ensure traders do not get too focused on frequent withdrawals at the expense of well-known trading. However, the full disclosure of Topstep payout instructions and quick ACH or wire transfer processing continue to make them a legitimate futures prop firm.

Countries Restricted at Topstep

Topstep is one of the top global futures funding firms but still has to use some pretty stric financial regulations and sanctions lists. In 2026, the prop firm will still be able to offer services to most of the foreign traders. However, a few territories will still be off-limits due to regulatory restrictions or their own risk management policies.

- Russia

- Belarus

- North Korea

- Iran

- Syria

- Cuba

- Selected regions of Ukraine (Crimea, Donetsk and Luhansk)

- Various other jurisdictions on the OFAC Sanctions list

Traders are kindly advised that due to any regulatory or payment provider changes, country lists for restrictions might be changed or removed.

If you are trading from a region where it is allowed, very crucial is your first registration confirmation of residency to be able to make a Topstep payout easily. If you have doubts about your exact country then the best thing is to contact the Topstep support team for the latest updates on regulation.

Our Final Verdict on Topstep

No other firm in the 2026 futures prop market can quite match the "Gold Standard" status of Topstep - as the most stable, transparent and disciplined environment it continues to attract intraday traders worldwide.

Since Topstep has reduced its Trading Combine to just one test phase and eliminated the complicated scaling plans, it has brought its rules closer to the forex traders who come over through the Topstep forex to futures conversion program.

The strict enforcement of daily loss limit rules at Topstep as well as the consistency target (a single day profit should never violate the 40% threshold of total profits) is the way they ensure the capital preservation. Besides that, the trade-off is still very attractive because of regular giveaways and the abolishment of most reset fees. This "performance-first" attitude is well supported by top-notch education and a dependable payout system from Topstep wherein traders are entitled to retain 100% of their initial $10,000 earnings.

In general, Topstep would be a great fit especially if you want to have a professional experience in a regulated market using platforms such as TopstepX or NinjaTrader. However, if you are the type of trader who cannot handle the daily drawdown or simply enjoys the decentralization of spot Forex then the futures, only scheme might be a tough challenge for you.

Take a look at the latest pricing and verified prop firm offers, reviewed by The Trusted Prop.