Nostro Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Nostro review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.2

4.2

Nostro

Forex, Crypto, Commodities, Indices

GB

2023

CEO: Not publicly available

Coupon Code:

Metatrader 5

Wire Transfer/ Bank Transfer

Rise

Crypto

WISE

Visa

Introduction to Nostro Prop Firm

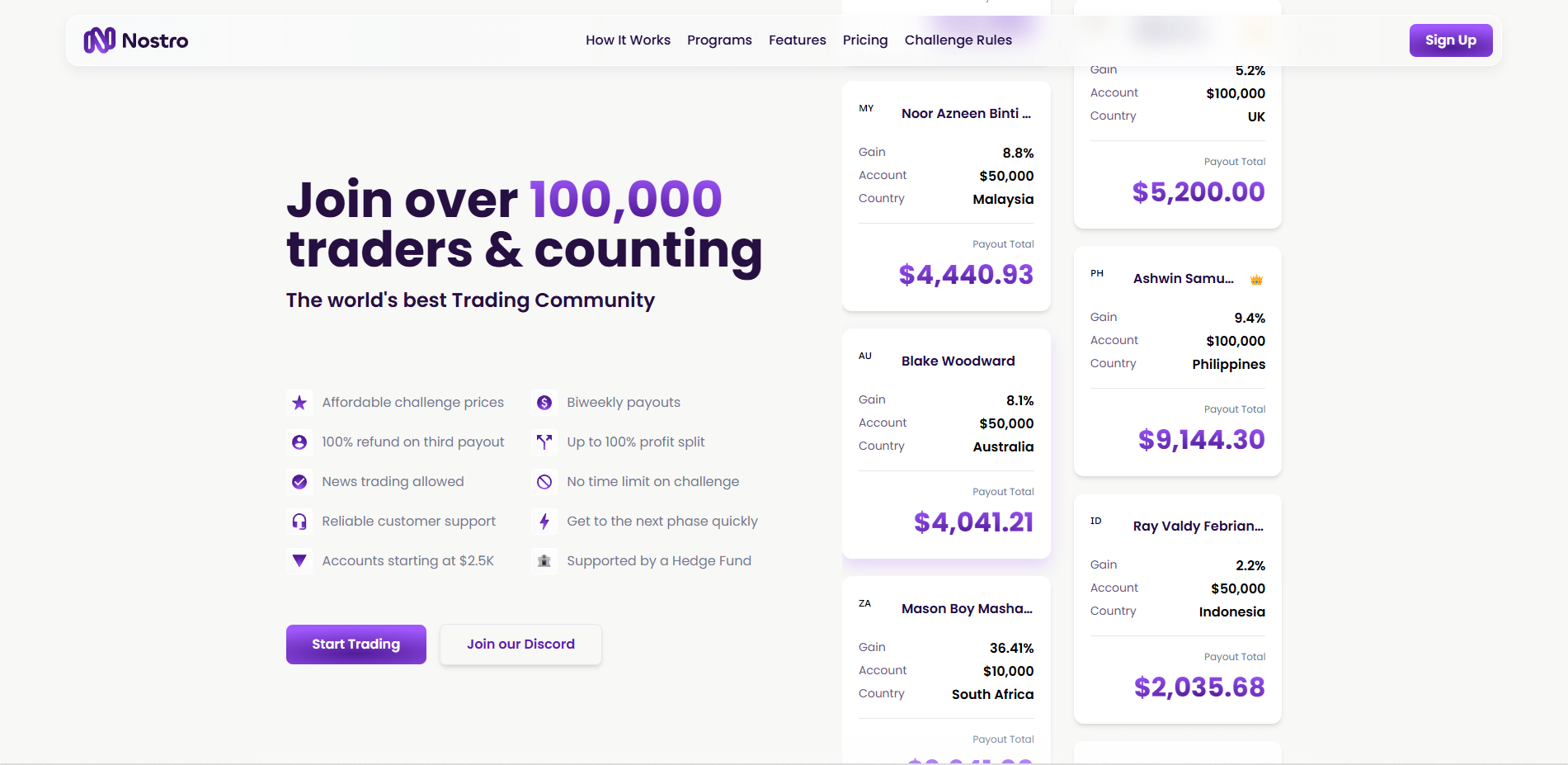

Founded in 2023, Nostro is a London‑based propr trading firm that lets traders test their edge on time‑unlimited 1‑, 2‑ or 3‑step challenges for accounts up to $100 000.

Its Consistency‑Score model rewards disciplined performance with a sliding profit split that can reach a rare 100 %, while most funded traders still pocket 80 %.

Payouts are processed every 14 days (minimum $50) via crypto, PayPal, Revolut or bank wire, keeping access to profits fast and flexible.

Because Nostro runs its own MT5 server rather than an external broker, trades execute in a controlled, latency‑optimised environment and there are no monthly platform or data fees beyond the one‑off evaluation cost.

Traders can speculate on forex, indices, commodities, crypto and U.S. stocks, all from the familiar MetaTrader 5 terminal.

A Trustpilot score around 4.5/5 suggests the model is resonating with its growing community, and newcomers can still shave 40 % off entry fees with coupon code IN40.

Nostro Prop Firm Overview

| Feature | Details |

|---|---|

| Company Name | Nostro Prop Firm |

| Company Name (Legal) | NOSTRO LIMITED |

| Registration No. | The legal number of Nostro is 14971445 (UK Companies House) |

| CEO / Founder | Scott O’Sullivan is the CEO & Co‑Founder of Nostro |

| Headquarters | Nostro is registered in London, United Kingdom |

| Year Launched | Nostro has been operating since 2023 |

| Broker | Nostro Markets is the broker of Nostro with MT5 platform integration (“Nostro Markets”, simulated environment) |

| Account Model | Nostro provides challenge‑based evaluation (1‑, 2‑, 3‑step; no time limit) |

| Challenge Fees | One‑time evaluation fee for Nostro Challenges starts from $23 to $640 |

| Profit Split | Nostro offers 40% - 100% profit split (tiered by Consistency Score; 80 % typical) |

| Account Sizes | $2.5K, 5K, 10K, 25K, 50K, 100K |

| Payout Timing | Nostro payouts every 14 days; min $50 request via Crypto/Bank/PayPal/Revolut |

| Financial Markets | Forex, Indices, Commodities, Cryptocurrencies, and U.S. Stocks are offered by Nostro |

| Platforms | MetaTrader 5 trading platform is supported by Nostro (desktop, mobile, web) |

| Trustpilot | Nostro has a 4.5 / 5 rating on Trustpilot |

Pros and Cons of Trading with Nostro Prop Firm

Trading with Nostro Prop Firm offers a modern, trader-friendly model built around flexibility, consistency, and transparency. With no time limits on challenges, tiered profit splits that reward discipline, and zero recurring fees, it's designed to empower long-term performance. However, the firm still has improvements to cover, and its internal systems and policies may not suit every trader’s style or expectations. Here's a balanced look at the key advantages and drawbacks:

| Pros | Cons |

|---|---|

| No Time Limit on Challenges | Take the evaluation at your own pace without added pressure. |

| New & Less Proven | Founded in 2023, limited long-term reputation or track record. |

| 100% Profit Split Potential | High consistency is rewarded with top-tier payouts. |

| Low Initial Trustpilot Volume | Fewer public reviews compared to older firms. |

| No Monthly Fees | One-time entry cost; no platform or subscription charges. |

| Tiered Payout Requires Consistency | Traders must meet performance metrics for higher splits. |

| Fast Payouts | Withdraw profits every 14 days via multiple flexible methods. |

| Crypto-Heavy Infrastructure | May not appeal to traders preferring traditional brokers. |

| Internal MT5 Server | Lower latency and more control over execution quality. |

| Limited Platform Choice | Only available on MetaTrader 5 (no cTrader or TradingView). |

Nostro Challenge Types, Fees, Profit Split & More

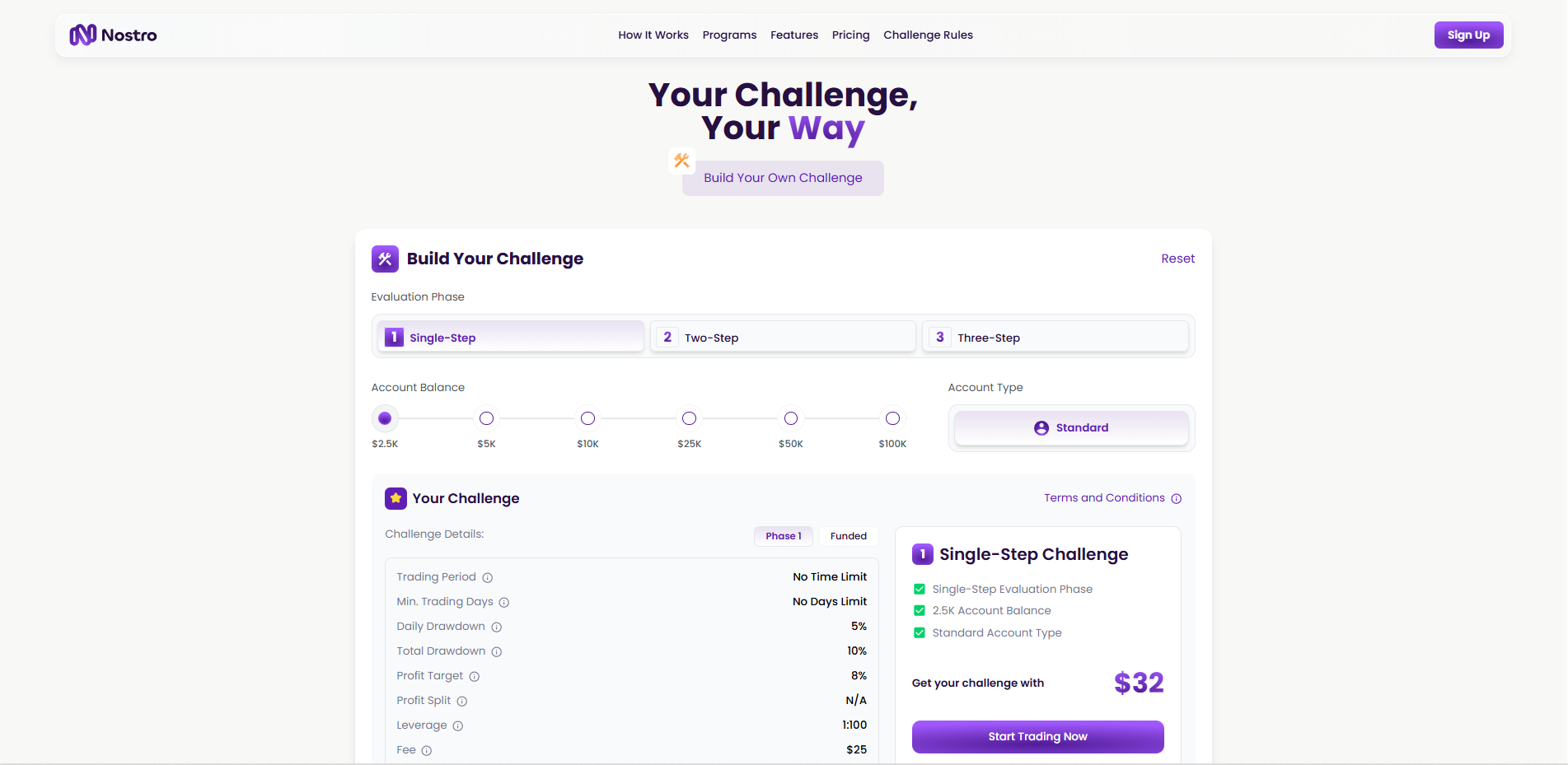

In terms of challenge variety, virtually all models at Nostro accommodate traders of different risk profiles and levels of experience. If you are someone who wants to fast-track their way to funding, the 1-Step will work for you. For those who want some structure, there’s the 2-Step. And, if you want to dig in and grind, there’s the 3-Step. Also, account sizes range from as low as $2,500 and going all the way up to $100K, allowing traders to scale sensibly and cost-effectively. All challenges are time unlimited, have generous drawdown limits, and up to 100% profit share once funded. Add that to the consistent 1:100 leverage, and you have a flexible, trader-focused system that doesn’t confine, stifle, or accelerates your growth.

Let’s break down each challenge model and contras with competitors.

Challenge Type Comparison Table

| Model | Account Sizes | Fee Range | Drawdown (Daily/Total) | Profit Target (Phases) | Min. Days | Leverage | Time Limit | Profit Split (Funded) |

|---|---|---|---|---|---|---|---|---|

| 1-Step | $2.5K - $100K | $32 - $640 | 4% / 6% | 10% (Single Phase) | None | 1:100 | Unlimited | Up to 100% |

| 2-Step | $2.5K - $100K | $23 - $500 | 5% / 10% | 8% + 5% | Unlimited | 1:100 | Unlimited | Up to 100% |

| 3-Step | $10K - $100K | $48 - $380 | 5% / 10% (All Phases) | 8% + 5% + 5% | Unlimited | 1:100 | Unlimited | Up to 100% |

1-Step Challenge at Nostro

Traders who want to get funded promptly without dealing with multiple evaluations will do well in the 1-Step Challenge by Nostro. Within this challenge, there is only one phase to complete - achieving a profit target of 10%, staying within a 4% daily drawdown, and a 6% overall drawdown. The lack of trading day minimums and time restrictions means you can fully customize how your strategy.

1-Step Challenge Account Details

| Account Size | Profit Target | Daily Max Loss | Total Max Loss | Account Fee |

|---|---|---|---|---|

| $2.5K | $250 | $100 | $150 | $32 |

| $5K | $500 | $200 | $300 | $54 |

| $10K | $1,000 | $400 | $600 | $99 |

| $25K | $2,500 | $1,000 | $1,500 | $240 |

| $50K | $5,000 | $2,000 | $3,000 | $400 |

| $100K | $10,000 | $4,000 | $6,000 | $640 |

Why Choose the 1-Step Challenge?

- The Fastest Route To Funding- all it takes is one challenge to complete in order to receive funding.

- No Activity Minimum - Freely choose your pace without being forced to perform additional trading activity.

- Low Barrier Entry - Pricing is as low as $32 so all levels of trader experience can access it.

2-Step Challenge at Nostro

Nostro’s Two-Step Evaluation is meant to recognize consistency and growth. In Phase 1 you attempt an 8% cap, while in Phase 2 a 5% cap. Unlimited trading days means there are no time constraints so traders avoid making choices based on pressure or stress. For those with a preference for consistent performance, there are softer parameters and increased drawdown limits of 5% daily and 10% overall.

2-Step Challenge Account Details

| Account Size | Profit Target Phase 1 | Profit Target Phase 2 | Daily Max Loss | Total Max Loss | Account Fee |

| $2.5K | $200 | $125 | $125 | $250 | $23 |

| $5K | $400 | $250 | $250 | $500 | $44 |

| $10K | $800 | $500 | $500 | $1,000 | $90 |

| $25K | $2,000 | $1,250 | $1,250 | $2,500 | $210 |

| $50K | $4,000 | $2,500 | $2,500 | $5,000 | $360 |

| $100K | $8,000 | $5,000 | $5,000 | $10,000 | $500 |

Why Choose the 2-Step Challenge?

- Equidistant Gap Between Fast and Safe - two tiered phases keep complexity low but maintain accountability.

- Low Cost - Starting price is only $23 for a 2.5K funded account.

- Perfect for Consistent Traders - There is a well balanced structure for uninterrupted disciplined trading.

3-Step Challenge at Nostro

The 3-Step Evaluation is tailored for professional traders that are looking to demonstrate consistency over the long term. You will complete three phases with profit targets 8%, 5%, and 5%, respectively. Each step has the same drawdown limits 5% daily and 10% overall. This ensures that there is structure along with a repeatable evaluation. This is the ideal roadmap for traders wishing to demonstrate endurance and adaptability across multiple phases.

3-Step Challenge Account Details

| Account Size | Profit Target Phase 1 | Phase 2 | Phase 3 | Daily Max Loss | Total Max Loss | Account Fee |

|---|---|---|---|---|---|---|

| $10K | $800 | $500 | $500 | $500 | $1,000 | $48 |

| $25K | $2,000 | $1,250 | $1,250 | $1,250 | $2,500 | $160 |

| $50K | $4,000 | $2,500 | $2,500 | $2,500 | $5,000 | $260 |

| $100K | $8,000 | $5,000 | $5,000 | $5,000 | $10,000 | $380 |

Why Choose the 3-Step Challenge?

- Traceable Growth Potential - Ideal for traders who respond positively to designated boundaries and long-term strategy.

- Least Expensive for 10K Challenge only at $48, which is very competitively priced.

- Constructed for Advanced Growth – Sets the stage for future development under genuine stress.

Our Review on Nostro Challenge Types, Fees, Profit Split & More

Nostro stands out among prop firms for having flexible challenge structures at some of the lowest price points in the industry. Beginner traders with a $2.5K account or a seasoned trader aiming for $100K+ in capital both have a strategy that accommodates their needs and budget. The 1-Step model is perfect for fast movers who want to skip waiting and prove profitability in one phase (albeit this model has tighter drawdowns). The 2-Step challenge is classic with sensible buffers and a more comprehensive evaluation, making it the favorite among traders that want low cost and plenty of adaptability while still keeping things realistic. Meanwhile, the 3-Step challenge adds an extra layer of rigor which is great for long-term traders who prefer a slow and steady approach to the high capital and up to 100% profit split.

The most unique feature offered by Nostro is the zero time pressure. A very uncommon feature in this industry. With low overhead costs, you can strategize, trade, and scale at your own speed. Responsible trading is well supported. 1:100 leverage and unlimited funded trading intervals make for one of the best trading ecosystems available.

Nostro Scaling Plan - Explained & Reviewed

After achieving the funded trader status at Nostro, traders' are not stopping there. Broadly, the firm’s scaling plan looks to reward traders with consistent profitability while managing risks prudently through capital expansion. By achieving predefined milestones, traders gradually unlock access to higher funding brackets over time, which also allows them to increase their accounts.

This scaling system is designed with long-term growth in mind, encouraging traders to trade smart instead of fast.

Nostro Scaling Criteria Table

| Scaling Tier | Requirement | Scale-Up Account Size |

|---|---|---|

| Tier 1 | +10% profit | Account x 1.5 |

| Tier 2 | +25% cumulative profit | Account x 2.0 |

| Tier 3 | +50% cumulative profit | Account x 3.0 |

Note: Violations on profit milestones, drawdown limits and trading rules will result in unachievable milestones resulting in no profit.

Our Review on Nostro Scaling Plan

With targets set realistically, multipliers offered on scaling are not too generous or unbeneficial, while profit milestones are equally approachable. Even more so, the scaling plan was brilliantly designed to eliminate unnecessary pressure to trade excessively, encouraging long-term consistency over short term aggression. The lack of restrictions on time is a welcomed bonus.

We really enjoy the ease, their is no tier system or hidden complexities. Simply trade within the rules and increase your funding. If a trader is serious about building a career, Nostro provides a streamlined approach enabling career progression to prop trading capital seamlessly.

Spreads & Commissions at Nostro - Transparent, Flat, and Fair

If there is one thing a trader seeks at a prop firm, its consistency and pricing structure. Nostro performs excellently on this one. For Forex, Crypto, Gold, or even Oil, trading at Nostro is easy – just pay $4 per standard lot of RAW (round turno) commission on most asset classes and left with simple trade RAW spreads.

Here’s a breakdown of how it works per asset class:

| Asset Class | Commission (per standard lot round turn) | Notes |

|---|---|---|

| Forex | $4 | Applies to all FX pairs. Raw spreads, no markup. |

| Crypto | $4 | Includes BTC, ETH, LTC, etc. |

| Metals | $4 | Gold, Silver, Platinum, all at the same flat rate. |

| Energies | $4 | Crude Oil, Natural Gas - same transparent fee. |

| Indices | $0 | Yes, ZERO commission for major indices like S&P 500, NASDAQ. |

Why This Matters:

Pricing is clear so you do not bother about fees and can instead focus on trading. Percentage markups can get in the way, especially for high volume traders, where profits at the pip level can be very crucial.

Daily & Maximum Drawdown Rules – How It’s Calculated at Nostro

Drawdown rules are predefined measures of risk exposure for an account over time and they can make or break your challenge. Rules at Nostro try and balance the two for fair and clear boundaries that allow planned trades.

Drawdown is: Based on Equity at the Drawdown Level 7 PM EST

Each trading day, or rather shift, comes with a set draw out share limit for any losses incurred throughout the session. Hence these sate equity limits form the basis for your withdrawals throughout the trade (7 PM EST). Evaluation or Funded Phase for you, doesn't really matter.

| Account Type | Max Daily Drawdown |

|---|---|

| Paid Challenge Accounts | 4%–6% |

| Free $5K Accounts | 3% |

Example Scenario:

- Example Scenario: Balance at threaders full circle is hodl 5040 thru and thru.

- Drawdown threshold consition area is 250 dollars underneath your projected target. Hence your target for your second new day becomes dwelling on 4988 at base.

- Averagely, midway reiterating tradeable ka bawah from my tradeable point can defy. This should allow a give or take estimation of barely nominal draw away limit designed.

Important Notes:

- You'll be pleased to learn that your cap on max draw stays constant rolling all the way through till 7 PM EST reset point.

- Assessing losses once day closes, careful using adjustable limits can breaching nominal while still without noticed mitigate a lope of limit defy mark.

- Make sure to verify your limits from your dashboard before and after rolling over to prevent breaching your limits.

Maximum Drawdown: Your Overall Safety Net

Maximum drawdown spans the entire duration of your account, while daily drawdown references your risk per single day.

- The maximum drawdown for your account will always be calculated based on your highest equity.

- Your account will be disabled if you social breach drawdown conditions and you won’t be provided a second chance.

- Traders are prevented from placing reckless bets and chasing losses due to these conditions.

Our Take on Nostro’s Drawdown, Spreads & Commissions

Drawdown limits and commissions can be a deal-breaker for many traders out there, and to be honest, I understand why. However, once again, Nostro manages the tradeoff between control and flexibility surprisingly well.

Let’s talk about the drawdown first.

What we particularly enjoy is how it is equity based and calculated once a day at 7PM EST. This system has some room for strategy and scope for downside risk. Unlike some firms that bother changing limits intraday and catching traders unaware, Nostro keeps things predictable through its rollover-based approach. With that said though, overnight trades have to be managed very carefully. One unrealized gain can expand your buffer and vanish before you wake up. Smart traders will love this but impulsive ones? Better invest in some alarms.

Then, the commissions area. Set up, they are flat and fair, which makes things better for virtually all traders.

Turning to Forex, Crypto, Metals, and Energies, a $4 round turn commission is about as trader friendly as it gets. No secret spreads and no asset based markups. It’s all straight math, which makes managing costs even down to the pip easier. Oh yeah, I forgot – zero commissions on Indices. That’s not easy to touch, especially not on major names like S&P 500 and NASDAQ.

To put it simply, Nostro offers a no-nonsense approach when it comes to fees. They provide a straightforward fee structure that is easy to understand in conjunction with fair drawdown rules. Each of these incentivizes true risk management rather than capricious gambling. If you are the type of trader who prefers a protective framework yet does not wish to be choked by one, Nostro will offer complete satisfaction with how its rulebook is crafted.

Nostro Trading Rules Explained

Understanding that one has a unique trading rule set is essential before starting to trade with Nostro. Unlike some firms that operate within vague or confusing parameters, Nostro has an explicit trading structure that guides traders towards intelligent risk management while eliminating carelessness and aimless risk-taking. There are rules about caps on trade sizes, consistency scoring, and even strategy implementation. All of these rules are crafted to shield the trader and the firm at the same time. And yes, this also includes rigid frameworks regarding soft breaches, metrics on profit-sharing, and verification systems. Planning to trade here? Be profitable, but more importantly, compliant.

Strategies Allowed & Not Allowed at Nostro

| Category | Allowed? | Details |

|---|---|---|

| Manual Trading | Yes | Fully permitted, including discretionary trading |

| Expert Advisors (EAs) | Yes (with rules) | Allowed if compliant with the rules. May require verification EAs ticking scalping, arbitraging, toxic flow, or high-frequency trading (HFT) behaviors are banned |

| Copy/Group Trading | No | Not allowed: cross-account collaboration, PAMM systems, or precise trade mirroring |

| Hedging | No | Fully prohibited: inverse pairs, same account or cross account |

| News Trading | Yes for Evaluation Phase No for Funded Accounts | Evaluation phase only Funded: No new trades two minutes before or after major news. Trading around news in funded accounts may lead to violations |

| One-Sided Bets | No | Not allowed: oversize trades without risk controls |

| Third-Party Management | No | Not allowed: Self-managed accounts only |

Other Important Notes Every Nostro Trader Should Know

- Risk Per Trade Cap: Limited to two percent max risk per trade per symbol. Breaching this results in a soft breach then disqualification. Soft breaches incur a penalty or and ultimately lead to disqualification.

- Soft Breach System: Three-account terminations, whether in evaluation or funded phase, after one too many warnings on the third breach.

- Consistency score: Whether or not you profit-share depends on how consistently you trade. Blowout wins in one single day? That slashes your payout share down to forty percent.

- Minimum 5 Trading Days: This rule is applicable to both the evaluation and funded phases. If this is skipped, a phase redo will be required.

- Max Funding Cap: Putting no more than $100K in total active funded capital with Nostro. There’s no stacking 5 accounts to hit $500K here.

Our Review on Nostro Trading Rules

Nostro has a serious but fair approach to risk and trading behavior. Their rules foster order rather than chaos, discipline rather than randomness. The 2% risk cap per trade is an excellent filtering mechanism for impulsive traders and advocates for a more sustainable strategy. What stands out is their soft breach system - provision to recover from failure, but not enough to slip repeatedly.

Their profit-sharing tied to consistency as described is brilliant - it benefits traders who gradually and consistently grow, as opposed to those who manage to hit it big in a single day. Coupled with their strict stand on hedging, copy trading, and the timing of news events, it’s safe to say this is a platform that truly vets for professionalism. If you are serious about trading, as opposed to gaming the system, Nostro has one of the most robust rulebooks in the industry.

Trading Instruments Offered by Nostro

At Nostro, you’re not boxed into a handful of pairs or assets. If it is in your platform’s watchlist, it is tradable. That encompasses a breadth of forex pairs including commodities such as gold and oil, US major indices like the S&P 500 and US30, and a growing list of cryptocurrencies like Bitcoin and Ethereum.

Whether you be a day trader looking to scalp moves on the NASDAQ, a swing trader targeting GBP/JPY breakouts, or a crypto enthusiast riding the weekend volatility, Nostro gives you the freedom to trade at your discretion.

In short? If it moves and it is on your trading screen, you can trade it.

Payment Methods and Payout Process at Nostro

Getting Paid at Nostro? It is very simple-and trust us, that is something we appreciate.

Traders can request payouts every fourteen days and how much you withdraw depends on your Consistency Score (yes, how evenly you made your profits counts). The minimum withdrawal amount is just $50, meaning it is feasible even for part time traders or those just starting out.

Nostro ensures cashing out is quick and easy along with supporting the following services:

- Cryptocurrency (BTC, ETH, USDT, etc – remember there’s an admin charge of $10)

- Bank Wire Transfers

- Paypal

- Revolut

All payout requests are completed through your Challenge Dashboard, and Nostro states a 72 business hour processing window for requests excluding weekends. Though crypto and Paypal payouts are generally faster, bank wires depending on your geographical banks can slow the process down by a few days.

Challenge Fee Refunds? Yes, But with a Catch

Refunded transaction fees are only available after passing all evaluation stages along with the successful third payout. There is one stipulation to qualify: the account needs to be purchased at above $30 or else if the account is under then Nostro offers the same sized account at no cost. Not too shabby right?

KYC and Funded Account Setup

Once you pass the evaluation step of the challenge you require document verification best known as the KYC (Know Your Customer) procedure. This includes logging into your account as well as identity verification, signing a digital version of the contract, and you are good to go. Nostro states that a reset will be done to your account and a funded version will replace it post haste.

Our Review of Nostro’s Payout System

To be frank, payment from Nostro occurs bi-weekly, which is relatively frequent compared to other firms. Their payment options are also comprehensive. Another positive is the way the firm structures the payout rates based on the trader's activity level. It appears that the firm rewards traders who practice smart, consistent trading as opposed to incentivizing traders who depend on wild strokes of luck.

The only concern we could find was the delay on the refund during the third payment. However, relative to the industry, this is reasonable considering how many firms offer no refunds at all.

In summary, for traders needing consistent reward, reliable fees, and disciplined trader behavior, Nostro has one of the friendly payout systems in 2025.

Countries Restricted by Nostro

Before jumping in, here’s something important: Nostro doesn’t currently accept traders from certain high-risk or sanctioned regions. These include

- United States (USA)

- Russia

- North Korea

- Iran

- Sudan

- Republic of Sudan

- Syria

- Cuba

- Belarus

- Myanmar

- Libya

- Somalia

- Yemen

- Venezuela

- Eritrea

- Region of Crimea

- Central African Republic

- Chad

- Democratic Republic of Congo

- Iraq

Important: If you are located in these regions, you cannot open or keep a trading account under Nostro. This is a part of policies which all global businesses must comply with for sanctions and regulations.

This is because of compliance and regulatory frameworks that constrain nostros, so if you are from one of these restricted regions, sadly, you will not be able to become an account holder.

Our Final Verdict on Nostro Prop Firm

Speaking frankly, there is no need for Nostro to be tagged the most glamorous prop firm; it definitely stands head and shoulders above many trader-focused platforms in 2025.

What we adore the most is unrestrained flexibility. Nostro offers 1-step, 2-step, and 3-step evaluations, alongside a no time limit policy, which is evaporating in today’s rushed prop worlds. Here, you are not forced to feel the clock ticking, or maneuvered into high-risk trades just to beat a deadline. That’s uncommon and a breath of fresh air these days.

In addition, the scaling plan is refreshingly straightforward. Achieve your specific milestones, don’t take any foolish risks, and you’re on track to triple your funding. The steps are simple, there are no conflicts regarding profit sharing, which can reach up to 100%, and tools such as Expert Advisors (EAs) may be utilized as long as the rules aren't bent too much. There is a sensible equilibrium between freedom and rules.

Nostro's team focus much more on fostering low-break consistency than they do on fortunate randomness. Striking income from payout is associated with the Consistency score, meaning sculpted payouts for steady traders and reduced earnings for erratic ones. So, in a funding model intended for long-term trading careers, this approach is precisely what’s needed.

It is also evident that the commission structure is equitable: $4 per round-turn on almost all assets, with none charged for indices. Daily and max drawdown calculations are updated at rollover, and risk management can be conducted with full visibility as provided by the platform.

Support response time is a little inconsistent based on your payout method, and with the challenge fee refund being after three payouts, the pace may feel a bit slow to some. If you are from a restricted country like the US or Russia, you are also out of luck.

On the other hand, Nostro isn't built for hype-chasers. If you're after a stern prop firm with a reliable structure, wide-ranging challenges, high payout discretion, and plenty of growth potential, then Nostro likely sits high on your prop firm list.

No matter if you identify yourself as a scalper or swing trader and regardless whether you are still fine-tuning your long-term approach, this is a firm that appreciates your work, consistently rewarding your efforts, and this is exactly how prop trading should be in 2025.