Monevis Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Monevis review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

0.0

0.0

Monevis

Forex, Metals, Indices, Energies

ST

2023

CEO: Milos

Monevis is the next-generation prop firm, rooted in a clean tech model that enables traders to access funded capital. With plans ranging from instant funding to multi-phase challenges, Monevis promises flexible paths to be funded with verified blockchain payouts and backed up by an AI assistant that analyses your trading style. But like any firm, it has its trade-offs. In this Monevis review, we are going to take a closer look at what exactly this prop firm is offering to traders, so you can figure out if it’s the right fit for you.

Monevis Prop Firm Overview

| Category | Details |

| Company Name | The prop firm name is Monevis. |

| Legal Name | Monevis's legal name is Monevis s.r.o.. |

| Registration Number | Monevis's registration number is 55215921. |

| CEO | The CEO of Monevis is Milos. |

| Headquarters | The headquarters is located in Saint Lucia. |

| Broker | The broker associated with Monevis is Monevis Brokers. |

| Operating Since | Monevis has been operating for 2 years (Founded in 2023). |

| Account Sizes | Monevis provides account sizes ranging from $3K to $100K (across all account types). |

| Profit Split | Monevis offers a 50% (Instant) up to 85% profit split. |

| Challenge Types | Monevis offers Instant Funding, One-Step Challenge, and Three-Step Challenge. |

| Payout Cycle | Monevis offers payouts bi-weekly for Instant Funding accounts. |

| Payout Method | The withdrawal methods supported by Monevis are blockchain-verified payouts. |

| Trading Platforms | Monevis supports trading on their web terminal. |

| Financial Markets | Monevis supports trading in Common Financial markets. |

| Max Allocation | Monevis offers a maximum allocation of Not specified (initial max is $100K). |

| Max Scaling | Monevis provides scaling opportunities up to 90% profit split. |

Pros and Cons Of Trading With Monevis

Monevis pros are refvolutionary AI support and a flexible Instant Funding with a fixed drawdown. The cons, on the other hand, include the 30-day limitation of the Professional plan and restrictions such as no trading during the news and no holding over the weekend. Payouts are transparent and can be verified on the blockchain.

Here’s a balanced look:

| Pros | Cons |

| Low-cost challenge (Starting from around US$14–15 with promo) | Profit split is low at 50% for Instant Funding |

| Static drawdown for instant accounts provides a predictable risk limit | Very strict daily drawdown rule (2% for instant account) |

| AI Assistant to help traders excel by analyzing your trading style | Weekend holding not allowed on Instant Funding |

| Blockchain-verified payouts for transparency | Very low default leverage (1:6) on the Instant Funding accounts. |

| Flexible scaling with up to 90% profit split | Less long-term history - The firm was founded in 2023) |

Monevis Account Types, Fees & Profit Split

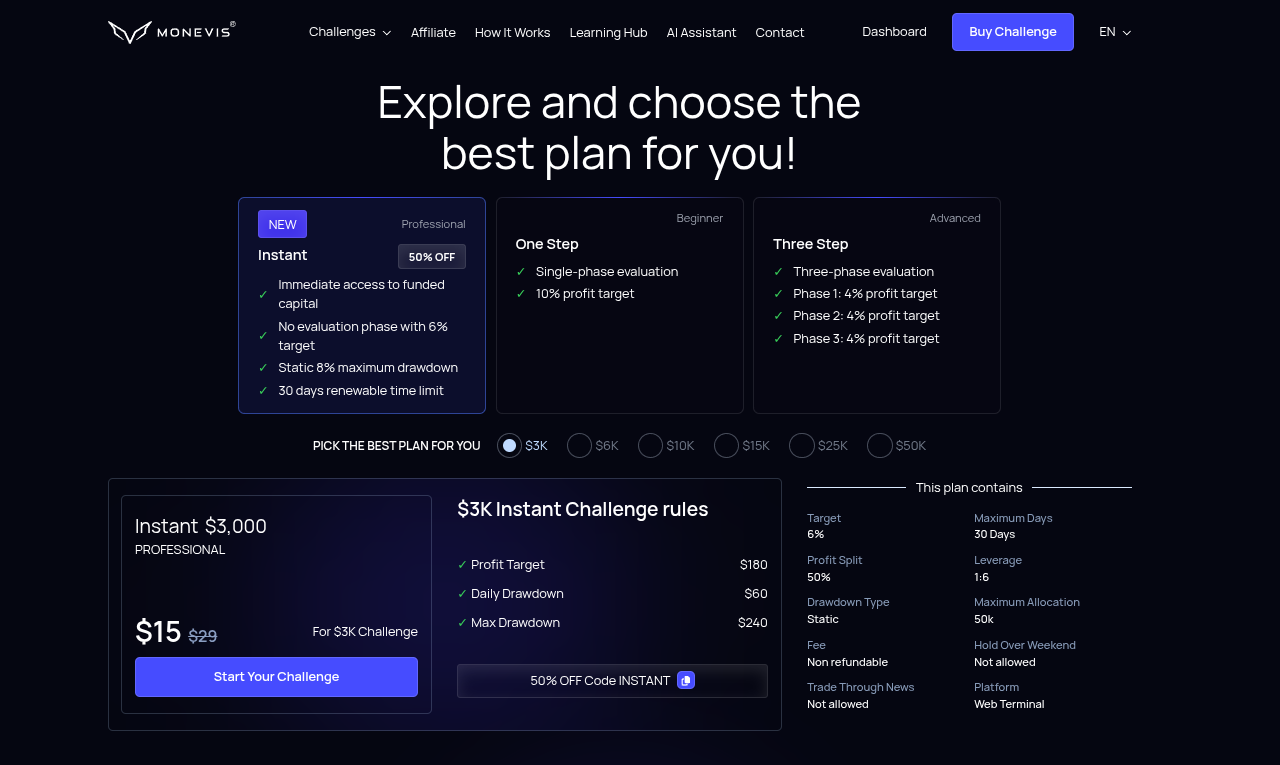

Monevis provides various Account Types: Instant (static drawdown, 50% profit split, no consistency), One-Step, and Three-Step evaluation challenge. The fees are depending on the account size (e.g., $29 for a $3K Instant). Traders with a funded account will receive a 50% Profit Split on the Instant plan, which is confirmed by blockchain payouts.

| Feature | Instant Funding | One-Step Challenge | Three-Step Challenge |

| Account Sizes | $3K to $50K | $5K to $100K | $5K to $100K |

| Account Fees (Start From) | $15 (for $3K) | $59 (for $5K) | $35 (for $5K) |

| Profit Target | 6% | 10% | 4% per phase ($12% total) |

| Daily Drawdown | 2% | 3% | 4% |

| Max Drawdown | 8% - Static | 6% - Static | 4% - Static |

| Drawdown Type | Static | Static | Static |

| Min. Trading Days | Not specified | 2 Days | 3 Days per Phase |

| Max Trading Days | 30 Days (Renewable) | 45 Days | 45 Days (Total) |

| Leverage | 1:6 | Up to 1:75 | Up to 1:75 |

| Profit Split | 50% | Up to 85% | Up to 85% |

Explanation of Each Monevis Account Type

Instant Funding

Monevis Instant Funding plan allows quick access to funded capital with a fixed 8% maximum drawdown and no consistency rules. You have to achieve a 6% profit target to be able to get the payout and to make your 50% profit share stay with you. This alternative has a time limit of 30 days, which can be renewed.

| Account Size | Account Fee | Profit Target (6%) | Max Daily Drawdown (2%) | Max Total Drawdown (8%) |

| $3,000 | $15 | $180 | $60 | $240 |

| $6,000 | $30 | $360 | $120 | $480 |

| $10,000 | $50 | $600 | $200 | $800 |

| $15,000 | $75 | $900 | $300 | $1,200 |

| $25,000 | $199 | $1,500 | $500 | $2,000 |

| $50,000 | $399 | $3,000 | $1,000 | $4,000 |

Why Choose Instant Funding

- Very quick path to funding for traders

- Traders get lower cost entry

- The plan remains flexible, but there are rules for risk management and trading strategies that ensure disciplined trading.

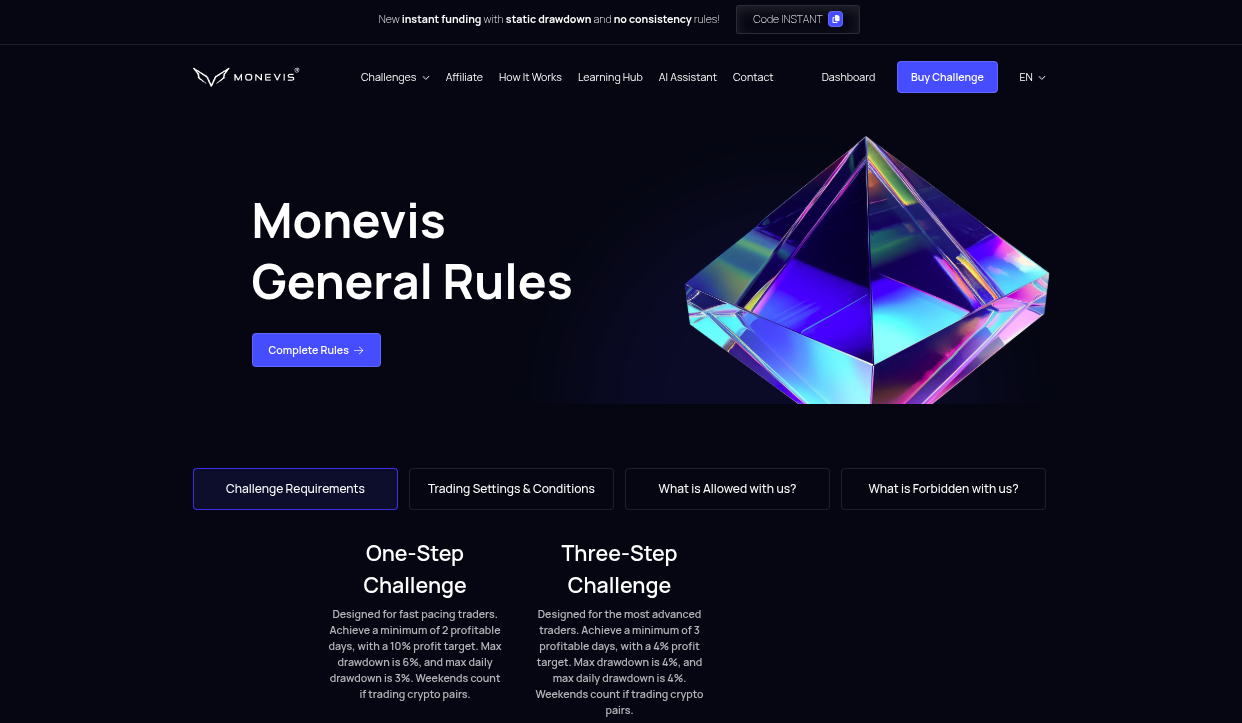

One-Step Challenge

The Monevis One-Step Challenge is a straightforward, single-stage test with a 10% profit target to get a funded account. It is perfect for a new prop trader who wants a simple way to take the challenge and get funded.

| Account Size | Account Fee | Profit Target (10%) | Max Daily Drawdown (3%) | Max Total Drawdown (6%) |

| $5,000 | $59 | $500 | $150 | $300 |

| $10,000 | $109 | $1,000 | $300 | $600 |

| $25,000 | $249 | $2,500 | $750 | $1,500 |

| $50,000 | $355 | $5,000 | $1,500 | $3,000 |

| $100,000 | $565 | $10,000 | $3,000 | $6,000 |

Why Choose One-Step Challenge

- Monevis offers a single-phase evaluation which allows traders to reach a funded account faster than multi-step challenges

- Such traders who are sure of their capability to handle drawdown and reach the profit target in one trading phase may find this to be their perfect option.

- More predictable evaluation path

Three-Step Challenge

The advanced trader is the target of the Three-Step Challenge, which comprehensive, three-phase evaluation. In each stage, a small profit target of 4% is set, making it a well-organized and demanding way of obtaining a funded account.

| Account Size | Account Fee | Profit Target (4%) | Max Daily Drawdown (4%) | Max Total Drawdown (4%) |

| $5,000 | $35 | $200 | $200 | $200 |

| $10,000 | $55 | $400 | $400 | $400 |

| $25,000 | $145 | $1,000 | $1,000 | $1,000 |

| $50,000 | $245 | $2,000 | $2,000 | $2,000 |

| $100,000 | $385 | $4,000 | $4,000 | $4,000 |

Why Choose Three-Step Challenge

- Provides for progressive testing and reduced risk by phase

- Ideal for disciplined traders who prefer systematic progressions.

- Enables one to build and perfect risk management with time

Our Review of Monevis Challenge and Instant Accounts

Based on our review of Monevis Challenge and instant accounts, we found that the firm offers different types of funded accounts to suit traders of all kinds. Whether you want to learn to manage risk via a 1-step challenge or get funded immediately - you have the choice at Monevis prop firm.

- Instant Funding is very beneficial in that a user can have access to the account almost immediately and with very few requirements. However, on the other hand, the trade-offs consist of a profit split that is less than what it would be normally and restrictions on news trading.

- The One-Step and Three-Step challenges provide traditional evaluation paths for traders who want to take time to prove themselves.

Overall, Monevis is quite flexible and appears to be constructed for new traders as well as those who are looking for more capital without overly aggressive leverage.

Monevis Drawdown and News Trading Regulations

Monevis uses a static drawdown model, so if you set 10% drawdown, your max drawdown will be fixed to start from your derived balance recalculated each day. For instance, with their Instant Funding option, it's 8% maximum drawdown in total.

When it comes to news trading, Monevis is very strict. On their account types, you can't trade during high impact news events. The firm has a news trading rule which states that all trades should be closed 5 minutes before and trades should only open 5 minutes after major news events.

Spreads & Commissions at Monevis

Monevis' funding model emphasizes on trader-friendly account fees, profit targets, and drawdown rules – rather than making money off of per-trade commissions. Therefore, the trader’s main cost arises from the challenge fee (account-purchase or evaluation fee).

Due to the lack of transparency within the per-trade commissions or variable spread data on their main challenge pages, traders should assume trading costs are built into their model and refer to Monevis support or documentation for further clarification.

Trading Instruments Offered by Monevis

Monevis supports trading popular financial markets through their web terminal (Monevis Brokers).

In most cases of prop firm offerings, trading common markets such as forex, metal,indices and energies would probably be allowed for you. Before taking a challenge, you should check their platform for the precise list of tradable markets.

Monevis Trading Rules - What's Allowed, What's Not

At Monevis, the firm has set a few risk management rules and trading policies so that traders manage risk properly and trade with discipline. Below are a few key trading rules at Monevis, based on their challenge structures:

| Trading Strategy / Practice | Allowed or Not | Details |

| News Trading | Restricted / Not Allowed | For Instant Funding accounts, there is a restricted window (5 minutes before and after) during which no trades are allowed in the vicinity of the major news events. |

| Overnight Holding | Not Allowed (Instant) | Holding trades over the weekend in Instant Funding is not allowed. |

| Leverage Use | Allowed | Leverage up to 1:6 is permitted for the Instant Funding account. |

| Consistency / Daily Target Rule | No Consistency Score (Instant) | There is no consistency rule for the Instant account. |

Prohibited Practices at Monevis

- Breaching (min-daily 2% drawdown on instant) results in account complications.

- Exceeding maximum total drawdown (8% on instant) leads to a violation.

Holding Position on forbidden news windows can result in rule violations.

Scaling Plan at Monevis

The profit splits at Monevis are extremely profitable and they are capable of increasing to 90% which is contingent on the account type as well as the trader's overall performance. It means that if you are profitable, you can earn a good percentage of profits for yourself. The firm provides an account scaling plan: after you have demonstrated your trading skill they will negotiate or offer higher profit splits, etc.

However, there is no public, specific “multi-step scaling plan” or transparent level system (like “after X trades or Y profit you scale to next level”) easily findable on their main challenge page. So yes, scaling is feasible, but is rather about profit share variations than tiers of flexible funding on a formal multi-leveled basis.

Monevis Payment and Payout Method

- Payment Methods: Practically you pay a challenge fee via online (On the website). Currently, the firm has not provided a list of payment options available on their website.

- Payout Options: When you are in profit and want to withdraw, Monevis conducts blockchain-verified payouts. They issue payout certificates, thus providing transparency to this system.

- Payouts: Payouts are bi-weekly for Instant Funding accounts. They also refer to “instant profit deduction from your account after payout request,” which would indicate that the balance updates in real time.

Countries Restricted at Monevis

Monevis does not provide services to residents of certain jurisdictions due to regulatory or legal reasons. Specifically, they mention:

- Democratic People's Republic of Korea

- Iran

- South Sudan

- Sudan

- Yemen

- Individuals/entities included in the ISIL (Da'esh) and Al-Qaida Sanctions Lists

- Taliban 1988 Sanctions List

- Other persons/entities specified in the First Schedule to regulations about terrorism financing

Our Final Verdict on Monevis

Monevis is one of the fastest payout prop firms providing trading assistance based on AI, simple funding, rapid execution, clear conditions and verified blockchain payouts. Its Instant Funding is unique in the industry due to low entry cost, no additional commissions, spreads mark-ups and transparent drawdown limits. But when it comes to Monevis, the customer support is not up to the mark as the firm is not available on Discord, and besides, they do not provide a well-structured FAQs section or a support chat with quick response.

Those who want to have multiple account types to choose from with transparent trading rules and fast payouts can consider Monevis but traders are also advised to be careful as their support is not strong and to try out small deposits before going for large funded accounts.

If you are sure to join Monevis, then click the “buy challenge” button to get started at a discounted Monevis account fee.