Lark Funding Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Lark Funding review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.8

4.8

Lark Funding

Forex, Crypto, Commodities, Indices

CA

2023

CEO: Matt L.

10% Off + Upto 400 Trust Points

Coupon Code:

cTrader

DXTrade

Wire Transfer/ Bank Transfer

Crypto

Credit/Debit Card

Crypto

ThinkMarkets

Eightcap

Lark Funding, with its unique single-phase challenge evaluation model, appears to be targeting prop traders with profits of up to 90% and funding exceeding $400,000. We can tell that they are, indeed, a new player in the industry but they have set their sights on becoming a favorite among traders as they offer lower fees, consistent payouts, and easy accessibility.

They offer fast execution and raw spreads with sub 0.0 pip spreads, hence their appeal to both scalpers and swing traders. Traders are provided with a challenge that has no time constraints alongside an accelerated scaling plan and bi-weekly payouts.

Does this mean Lark Funding is the best prop firm for your trading career? Let's find out together as we analyse the specifics.

Lark Funding Prop Firm Overview

| Features | Details |

|---|---|

| company Name | Lark Funding |

| company Legal Name | Lark Funding LLC |

| Registration Number | The registration number of Lark Funding is not publicly available. |

| Headquarters | Lark Funding is registered in Canada |

| Years in operation | Lark Funding has been operation since 1 years |

| Broker | The broker associated with Lark Funding is ThinkMarketsEightcap. |

| CEO | The CEO of Lark Funding is Matt L. |

| Challenge Types | The challenges offered at Lark Funding include One Phase Challenge, Two Phase Challenge, Three Phase Challenge. |

| Challenge Fees | The challenge fee for Lark Funding starts from $50 |

| Profit Split | Lark Funding offers 80-90% profit split |

| Account Sizes | Lark Funding challenge accounts range from 5,000-400,000 |

| Payout | Lark Funding provides Biweekly payouts |

| Financial Markets | Lark Funding offers trading instruments like Forex, Commodities, Indices, and Crypto |

| Trading platforms | Lark Funding supports trading on cTrader, DXTrade. |

| TrustPilot score | Lark Funding has a rating of 4.1/5 on Trustpilot |

Pros and Cons of Lark Funding Prop Firm

Lark funding is a global prop firm, distinguished by an up to 90% profit share, no minimum trading days and low evaluation fees. From a trader-first perspective, Lark Funding supports both novice and seasoned traders through simple funding rules, fast scaling options, and flexible terms. As any prop firm, it has its drawbacks as well. Below are the key pros and cons for you to consider when deciding if Lark Funding is the prop firm that suits your trading needs.

| Pros (Why Prop Traders Choose Lark Funding) | Cons (Things to Consider Before Signing Up) |

|---|---|

| Up to 90% Revenue Sharing | Absence of MT4 Support |

| No Minimum Trading Requirement | No Compensation Attempts for Unsuccessful Challenges |

| Fastest Payments (Within 1-2 Days) | Account Size Limitations Relative to Top Competitors |

| Cost-Effective Challenge Fees | No Immediate Funding (Requires Evaluation Completion) |

| Scaling Target Exceeding $500,000 | Funding Growth Limits Lower than Some Rivals |

| MT5 Platform Association with Low Spreads | Less Established Brand Internationally (Newer Firm) |

| Permits EAs & News Trading | Limited Community Features and Instructional Materials |

Lark Funding Challenge Types, Fees, Profit Split & More

If you are thinking about getting funded through Lark Funding, you are not short on options. This prop firm offers four unique challenge models the 1-Step, 2-Step, 3-Step, and Instant Funding each with its own blend of targets, drawdowns, and payout potential. Whether you are a fast-paced scalper or a cautious swing trader, there is a challenge tailored to your style.

And the best part? No time limits. That is right Lark gives you unlimited time to complete your evaluation, which is a rare relief in the prop firm world. From flexible drawdown structures to payouts up to 90%, it is worth taking a moment to compare each model before diving in.Here is a side-by-side breakdown to help you make the right call:

Lark Funding Challenge Comparison Table

| Details | 1-Step Challenge | 2-Step Challenge | 3-Step Challenge | Instant Funding |

|---|---|---|---|---|

| Profit Target | 10% (Phase), 0% (Master) | 8% (Phase 1), 5% (Phase 2), 0% (Master) | 5% (P1), 4% (P2), 3% (P3), 0% (Master) | No evaluation, trade instantly |

| Drawdown | 6% Static, 5% Daily | 10% Static, 5% Daily | 5% Static, No Daily Limit | 8% Max, 5% Daily |

| Leverage | 30:1 | 50:1 | 30:1 | 50:1 |

| Performance Split | 80% (Up to 90%) | 80% (Up to 90%) | 80% (Up to 90%) | 90% (Fixed) |

| Minimum Trading Days | 0 | 0 | 0 | 0 |

| Trading Period | Unlimited | Unlimited | Unlimited | Unlimited |

| Starting Fee | $1000 | $50 | $60 | $200 |

Lark Funding 1 Step Challenge

If you are a trader who prefers simplicity, no time pressure, and solid risk rules, the Lark Funding 1-Step Challenge might be exactly what you are looking for. Unlike other prop firms that make you jump through multiple phases, Lark keeps it clean Hit 10% once and you are in. No minimum trading days. No max duration. And best of all? You get a static drawdown instead of the annoying trailing kind that wipes you out after a winning day.

With account sizes up to $200,000, fast bi-weekly payouts, up to 90% profit split, and support for news trading and EAs, Lark Funding’s 1-Step program is built for serious traders who don’t want to overthink the rules. You focus on trading they handle the rest.

Lark Funding 1 Step Challenge: Account Size vs Fee Breakdown:

| Account Size | Challenge Fee | Drawdown (Static) | Daily Drawdown Limit | Profit Target | Leverage | Profit Split | Trading Time |

|---|---|---|---|---|---|---|---|

| $5,000 | $75 | 6% | 5% | 10% | 1:30 | 80% (up to 90%) | Unlimited |

| $10,000 | $125 | 6% | 5% | 10% | 1:30 | 80% (up to 90%) | Unlimited |

| $25,000 | $225 | 6% | 5% | 10% | 1:30 | 80% (up to 90%) | Unlimited |

| $50,000 | $325 | 6% | 5% | 10% | 1:30 | 80% (up to 90%) | Unlimited |

| $100,000 | $500 | 6% | 5% | 10% | 1:30 | 80% (up to 90%) | Unlimited |

| $200,000 | $1000 | 6% | 5% | 10% | 1:30 | 80% (up to 90%) | Unlimited |

Why Choose Lark Funding 1 Step Evaluation?

- No Time Limits - Take as long as you need, no pressure.

- No Trailing Drawdown - Your drawdown is fixed, not floating.

- Fast Payouts - Get paid just 14 days after reaching your target.

- Simple Rules - One goal: hit 10%, stay under 6% loss, and you are funded.

- Fair Pricing - Starting at just $75, it's one of the more affordable one-phase options out there.

- Trade Your Way - EAs, news trading, swing trades it is all allowed.

If you are tired of over-complicated prop firm models, Lark Funding 1-Step Challenge offers a straightforward path to a funded account without all the stress. Hit your target, trade smart, and keep most of what you earn.

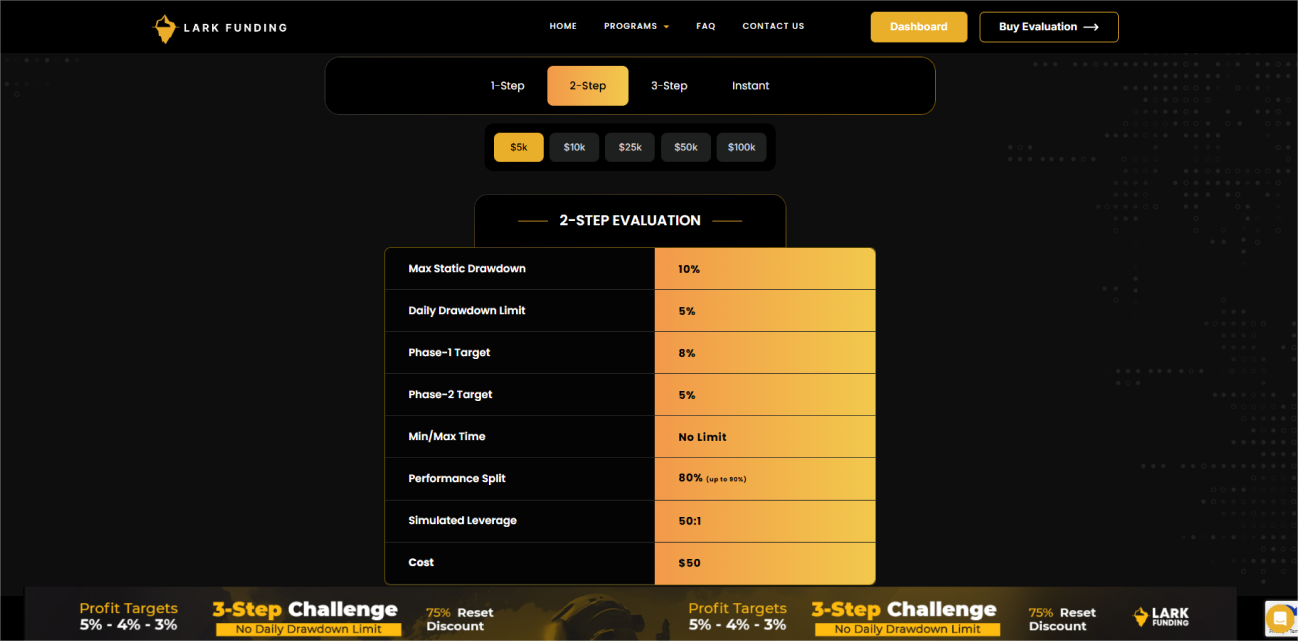

Lark Funding 2 Step Evaluation - Big Drawdown, Simple Rules, No Pressure

Looking for a prop firm that gives you breathing room, no ticking clock, and a fair shot at getting funded? The Lark Funding 2-Step Challenge might be your match.

Here is why: You have got no time limits, a generous 10% static drawdown, and no consistency rules to trip you up. Just hit 8% in Phase 1 and 5% in Phase 2, and you are in. That is it. Whether you take one day or one year Lark lets you trade at your own pace.

Plus, you will get bi-weekly payouts, up to 90% profit split, and support for news trading and EAs. For traders who don’t like being boxed into overly strict models, this Lark Funding 2 step challenge offers a lot of flexibility with some of the most forgiving risk rules in the game.

Lark Funding 2 Step Challenge: Account Size & Fee Breakdown:

| Account Size | Challenge Fee | Max Drawdown | Daily Drawdown | Phase 1 Target | Phase 2 Target | Leverage | Profit Split | Trading Time |

|---|---|---|---|---|---|---|---|---|

| $5,000 | $50 | 10% | 5% | 8% | 5% | 50:1 | 80% (up to 90%) | Unlimited |

| $10,000 | $90 | 10% | 5% | 8% | 5% | 50:1 | 80% (up to 90%) | Unlimited |

| $25,000 | $200 | 10% | 5% | 8% | 5% | 50:1 | 80% (up to 90%) | Unlimited |

| $50,000 | $300 | 10% | 5% | 8% | 5% | 50:1 | 80% (up to 90%) | Unlimited |

$100,000

| $500 | 10% | 5% | 8% | 5% | 50:1 | 80% (up to 90%) | Unlimited |

Our New 2-step challenge

| Features | Details |

| FX Leverage | 50:1 |

| Payouts | Bi-weekly |

| Martingale strategy | Allowed |

| Number of stocks | 100 |

| News Restriction | No News Restriction |

| Lock on payout | No lock upon payout |

| Consistency Rules | No consistency Rules |

Why Choose Lark Funding 2 Step Evaluation?

- No Time Limits - Take your time. There is no rush to pass.

- Huge Static Drawdown - 10% drawdown gives you real breathing room.

- Fair Targets - 8% + 5% is achievable, even with moderate risk.

- Bi-Weekly Payouts - First payout hits after just 14 days of your master account.

- News Trading & EAs Allowed - No restrictions on your strategy.

- Affordable Start - Entry fee starts at just $50.

Lark Funding 2 Step Challenge is made for traders who want structure but not suffocation. You have got clear trading rules, good flexibility, and strong reward potential. Hit your targets, trade smart, and you are on your way to a real payout.

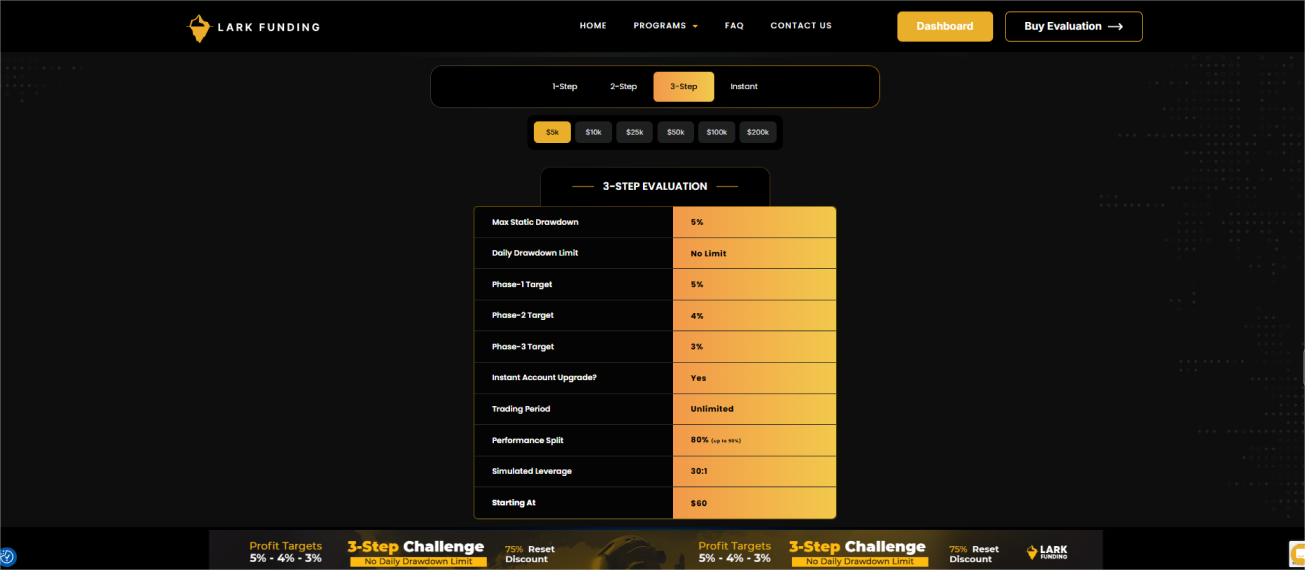

Lark Funding 3 Stage Challenge

If you are the trader who likes to build momentum step by step, the Lark Funding 3 Stage Evaluation might be your perfect trading fit. With no daily loss limits, no time pressure, and no trailing drawdown, this Lark Funding 3 Stage challenge gives you the space to breathe and the structure to grow.

You will progress through three simple phases: 5% in Phase 1, 4% in Phase 2, and 3% in Phase 3, with a total gain target of just 12%. And once you pass? You are a Lark Trader, eligible for up to 90% profit share and bi-weekly payouts every 14 days.

This program also includes perks like instant account upgrades and the ability to reset your challenge if needed. For traders who prefer a steady climb with fewer risks of disqualification, this challenge is built for you.

Lark Funding 3 Stage Evaluation: Account Sizes & Pricing:

| Account Size | Challenge Fee | Drawdown (Static) | Daily Drawdown | Phase 1 Target | Phase 2 Target | Phase 3 Target | Leverage | Profit Split | Payouts |

|---|---|---|---|---|---|---|---|---|---|

| $5,000 | $60 | 5% | No Limit | 5% | 4% | 3% | 30:1 (up to 60:1) | 80% (up to 90%) | Every 14 days |

| $10,000 | $105 | 5% | No Limit | 5% | 4% | 3% | 30:1 (up to 60:1) | 80% (up to 90%) | Every 14 days |

| $25,000 | $175 | 5% | No Limit | 5% | 4% | 3% | 30:1 (up to 60:1) | 80% (up to 90%) | Every 14 days |

| $50,000 | $240 | 5% | No Limit | 5% | 4% | 3% | 30:1 (up to 60:1) | 80% (up to 90%) | Every 14 days |

| $100,000 | $370 | 5% | No Limit | 5% | 4% | 3% | 30:1 (up to 60:1) | 80% (up to 90%) | Every 14 days |

| $200,000 | $700 | 5% | No Limit | 5% | 4% | 3% | 30:1 (up to 60:1) | 80% (up to 90%) | Every 14 days |

Why Go for the Lark Funding 3 Stage Evaluation?

- No Pressure - Take as much time as you need. No deadlines.

- No Daily Loss Limit - You won’t get kicked out for one bad trade.

- Instant Account Upgrades - Unlock better terms as you move forward.

- Reset Option - Made a mistake? You can restart your challenge.

- Reasonable Targets - Only 12% total gain needed across 3 stages.

- Starts at Just $60 - Super affordable for all account sizes.

TheLark Funding 3 Stage Challenge is ideal for traders who value patience, risk control, and gradual growth. If that sounds like your style, this program might just be the best way to get funded with fewer roadblocks.

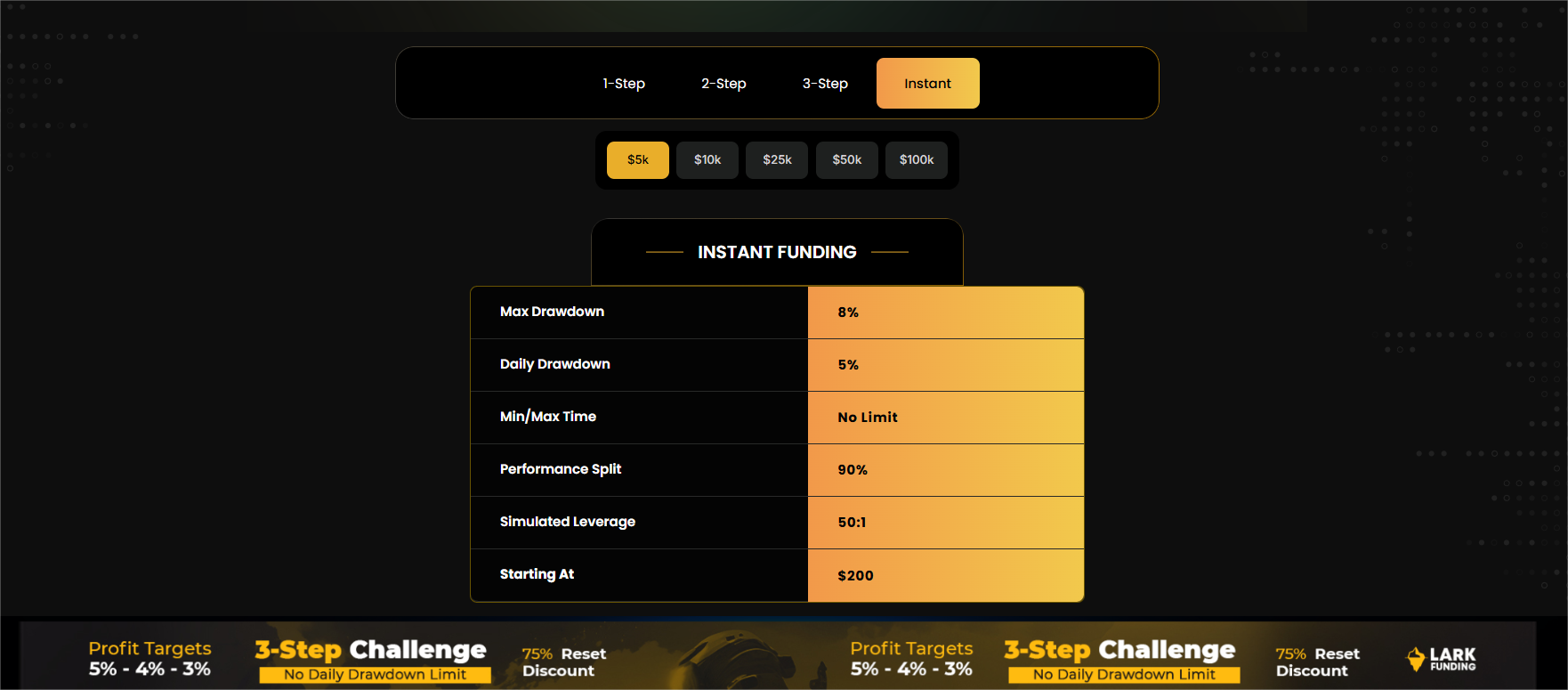

Lark Funding Instant Accounts - Skip the Challenge and Start Earning Today

Not a fan of trading evaluations? Want to go straight to earning profits without passing any phases? That is exactly what Lark Funding’s Instant Account is made for.

With this program, you skip the challenge phase completely and get direct access to a simulated funded account from Day 1. There is no waiting, no minimum trading days, and your first payout is available on demand, as soon as you are ready. You will trade with a generous 8% max drawdown, 5% daily loss cap, and enjoy a fixed 90% profit split on all simulated gains. It is the fastest way into the Lark ecosystem for serious traders who already know their game.

Lark Instant Account: Size & Pricing Breakdown:

| Account Size | Fee | Max Drawdown | Daily Loss Limit | Profit Split | Payout Frequency | Minimum Trading Days | Leverage |

|---|---|---|---|---|---|---|---|

| $5,000 | $200 | 8% | 5% | 90% | On Demand | 0 | 50:1 |

| $10,000 | $400 | 8% | 5% | 90% | On Demand | 0 | 50:1 |

| $25,000 | $1125 | 8% | 5% | 90% | On Demand | 0 | 50:1 |

| $50,000 | $2250 | 8% | 5% | 90% | On Demand | 0 | 50:1 |

| $100,000 | $4500 | 8% | 5% | 90% | On Demand | 0 | 50:1 |

Why Choose Lark Instant Funding?

- Start Immediately - No phases, no waiting. You are a funded trader from Day 1.

- Payout On Demand - Request your first withdrawal whenever you are ready.

- Generous Drawdown Rules - 8% total, 5% per day plenty of room to trade freely.

- No Consistency Rules - Focus on your performance, not your trade stats.

- Earn Up to 90% - Keep almost all of your simulated profits.

If you are confident in your trading and don’t want to deal with multi-phase challenges, the Instant Account from Lark Funding is a fast-track option with solid flexibility and industry-leading terms.

Final Review On Lark Funding Challenge

After breaking down all four of Lark Funding’s programs 1-Step, 2-Step, 3-Stage, and Instant Funding one thing becomes crystal clear: Lark is built for trader flexibility.

Whether you are a fast-paced scalper who wants instant access, or a swing trader who prefers a slow and steady climb, Lark has a challenge model that fits your pace, style, and budget. They are not trying to trap you in endless rules or rigid timelines. In fact, none of the challenges have time limits, and that alone sets them apart from so many other firms.

Here is a quick recap of what each model brings to the table:

- The 1-Step Evaluation is great for traders who like simplicity. Just hit 10% profit, stay under 6% static drawdown, and you’re funded. No phases, no fluff. Starting at $75, it is affordable and built for serious traders.

- The 2-Step Evaluation offers more breathing room with a generous 10% drawdown and a clear path: 8% + 5% targets. With no consistency rules, bi-weekly payouts, and starting fees as low as $50, this model balances challenge and freedom well.

- The 3-Stage Challenge is for traders who like to move in smaller steps. You work your way through 5%, 4%, and 3% targets, with no daily drawdown limit and a total goal of just 12%. Add instant upgrades, reset options, and a low $60 starting fee, and you've got a path built for steady, low-stress growth.

- The Instant Account is all about speed. Skip the challenge phase entirely and start earning simulated profits on Day 1. You get on-demand payouts, a solid 90% profit share, and risk parameters that let you trade your way. It is more expensive, but for skilled traders who don’t want delays it is worth every penny.

Lark Funding's Spreads & Commission Spread

Spreads

Every prop trader receives competitive trading conditions thanks to the collaboration that Lark Funding prop firm has with reputable brokers such as Eightcap and ThinkMarkets. Even though specific values concerning spread are publicly available, we know from acquaintances that these partnerships are known for tight spreads.

Commission Fees

- Forex and Metals: A fixed commission applied for all trades at the rate of $7 per standard lot.

- Commodities, Indices, and Cryptocurrencies: These markets have done away with commissions creating lower-cost trading opportunities. citeturn0search14

- The pricing model supports different trading methods, whether you consider yourself a high-frequency trader or a day trader or a swing trader.

Daily Drawdown Calculation at Lark Funding

The daily drawdown for Lark Funding is computed with respect to the trader's balance or equity, whichever is higher, and this amount is taken at the end of the trading day. There is a set drawdown limit of 5% and it resets daily at 5 PM EST.

Lark Funding Trading Rules For Discipline Based Trading

Trading without boundaries does sound appealing, but many will assume that it is an absolute free-for-all. In all honesty, no prop firm wanting to hand out six-figure accounts intends to see chaos. Lark Funding understands that. They have minimal restrictions that comes with accountability. In 2026, their trading rules are structured to allow the serious traders to thrive while avoiding reckless trading.

So, whether you’re an EA lover, a seasonal weekend scalper, or are simply looking to start with a mini account, Lark lets you operate. However, if you decide to not adhere to the rules, then you are risking much more than your phase reset.

Let's break down everything step by step on what trading strategies are allowed and not allowed at Lark Funding:

What Is Allowed At Lark Funding?

| Rule | Allowed? | What It Means |

|---|---|---|

| High-Impact News Trading | ✅ Yes | Trading news events is allowed, but using oversized positions may trigger “All-or-Nothing” violations. |

| Weekend Trading | ✅ Yes (with upgrade) | Weekend holds are allowed if you upgrade for 10% of your challenge fee. Otherwise, close trades by Friday 3:45 PM EST. |

| Weekend Copy Trading (Funded) | ✅ Yes | Copy trading between funded accounts is allowed. Not permitted in evaluation accounts. |

| Using Expert Advisors (EAs) | ✅ Yes | Smart EAs are fine. However, HFT or arbitrage strategies are strictly prohibited. Use advanced, not exploitative bots. |

| IP Address Restrictions | ✅ Yes | You can trade from different locations. Just inform the firm if you're crossing international borders. |

| Multiple Account Ownership | ✅ Yes | Multiple accounts are allowed, but total simulated capital must not exceed $400,000 across all accounts. |

What Is Not Allowed and Why.

| Rule | Forbidden? | Why It’s a Problem |

|---|---|---|

| Evaluation - Copy Trading | ❌ No | All evaluation challenges must be completed individually. Copying trades is not allowed as progress must be earned fairly. |

| HFT & Arbitrage | ❌ No | High-speed bots, tick scalping, and latency/price-feed exploiters are considered unfair advantages and are strictly banned. |

| Overleveraging | ❌ No | Using nearly all of your margin (e.g., 90% or more) is seen as reckless and unsustainable. |

| All-In Trades | ❌ No | Betting your entire account on one trade is viewed as gambling, not strategic trading, and violates risk management rules. |

| Scalping Abuse | ❌ No | While scalping is allowed, excessive hyper-scalping (like over 50% of trades under 1 minute) can lead to rule violations. |

| Martingale or Grid | ❌ No | Strategies that double down on losses or use layered orders (grid) are considered dangerous and unsustainable under prop firm risk standards. |

| Reverse Trading After Losses | ❌ No | Reversing trades immediately after a loss is not allowed. A minimum cooldown of 5 minutes must be observed to prevent impulsive behavior. |

| Third-Party Management | ❌ No | Only the trader registered with the account may trade. No hired traders, bots, or team-based management is allowed. |

| VPN Spoofing | ❌ No | Masking or spoofing your IP address with a VPN to hide location is considered deceptive and against platform trust policies. |

Prohibited Trading Strategies (And What Happens If You Try)

As a trader seeking as many opportunities as possible within Lark's ecosystem, you need to remain within strategies that can keep the firm afloat. The following strategies breach trader firm sustainability and thus should never be pursued:

1. All-or-Nothing Trading

A fast track to trouble is giving undue focus to one or two trades. Extremely risky trading.

Example: 90%+ margin accounts or large lot size additions during news events.

Result:

Evaluation: Phase 1 will be given as a free retry but no refund during reset.

Funded: That trade will not be considered during the three violation count leading to funding loss.

2. Martingale

Risking defaulting on a collection of requirements by repeatedly doubling a lost bet? We think of this as reckless abandon.

Consequence:

Evaluation: Phase revert for those in funded trades without payout.

Funded: No compensation will come from the payout for those trades not executed.

3. Grid Trading

Order layering without allocating specific risk thresholds for buy/sell price zones is reckless no matter the sophistication of your bot.

4. High-Frequency Trading (HFT)

Mimicking micro-second trades executed by a Wallstreet firm? Not on our watch.

5. Hedging Across Accounts

Lark can see through any attempts to circumvent their system by profiting from multiple accounts' hedging strategies.

Consequence: There will be no second chances with a permanent ban.

6. Share CFDs During Earnings

Do not hold stock CFDs with shares of individual companies during earnings. Cuts need to happen before 3:50 PM EST or be prepared for a hard breach.

Our Review on Trading Rules of Lark Funding

There are no complicated rules meant to trap you with Lark funding policies. All they want is to preclude those who gamify the system by providing skill based traders, not reckless gamblers, who employ balanced risk management strategies effortless chances.

Your style should be your own, but be smart about it. Funding is not about shooting your shot; it’s about claiming your domain methodically throughout the ride, consistently, under control, and on your way to earning it all.

Assets and Instruments for Trading Available at Lark Funding

Lark Funding hands traders a wide range of financial instruments tailored to their unique trading techniques and interests. Whether you are a Forex trader, an indices investor, or a commodities speculator, there are countless opportunities in highly liquid and volatile markets at Lark Funding. Here is a summary of the options and benefits available for trading:

Forex Trading

Traders have access to Forex trading at Lark Funding with a host of Forex currency pairs, including the major ones like EUR/USD, GBP/USD, and USD/JPY, in addition to minors and exotic. Traders can take part in efficient Forex trading with high liquidity and low competitive spreads, which allow them to benefit from minimal slippage and deep market access.

Lark Funding makes trading easier by offering an endlessly dynamic Forex trading environment for all strategies, whether you prefer to trade the stability of major pairs or the volatility of exotic currencies.

Indices Trading

Traders can access all the major global indices from US, Europe, and Asia, as well as popular ones such as S&P 500, Dow Jones, Nasdaq at Lark funding. Traders can take advantage of market movements while managing risk effectively due to maximum leverage of 1:10 on Indices Lark funding offers.

Cryptocurrency Trading

Lark Funding probably has the biggest selection of cryptocurrency to trade with out of all the prop trading firms allowing traders to take advantage of new and old crypto markets. The 1:2 maximum leverage gives traders the flexibility to trade 24/7 while also managing the risk due to the volatility of the cryptocurrency market.

Top Cryptocurrencies Available:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Cardano (ADA)

- Solana (SOL)

- Polkadot (DOT)

And more

With top-tier pairs such as BTC/USD, ETH/USD, LTC/USD, and XRP/USD, not to mention the ever-growing list of altcoins like ADA/USD, SOL/USD, and DOT/USD, Lark Funding ensures tight spreads and competitive execution at any time of the day.

Trade Commodities with Lark Funding - Metals, Energy & More

Lark Funding gives the opportunity to trade some of the most liquid commodities such as precious metals, energy products, and industrial materials which enables traders to market diversify and profit from global trends.

Traders can trade metal instruments such as Gold (XAU/USD) and Silver (XAG/USD), as well as energy commodities like UK Brent and US WTI Crude Oil with a maximum leverage of 1:10 which optimizes capital and helps manage the risk exposure.

Our Take on Trading Instruments

An analysis of the offerings from Lark Funding prop trading firm reveals that they are committed to fostering a range of diverse trading strategies. Lark Funding provides traders with numerous commodities such as metals, energgy products, and industrial materials which helps in effective risk management, taking advantage of market volatility, and portfolio diversification.

Lark Funding traders have access to gold, silver, crude oil, and more which allows traders to capitalize on global commodity trading and even have access to competitive spreads and risk-averse leverage. Foremost in importance, whether one deals in Forex, equities markets, cryptocurrency, or even commodities, Lark Funding provides unconditional access to prop trading under smooth operations and fair and clear guiding rules that seek to enhance trader capabilities in the market.

Lark Funding Payout Requirement and Process Explained

Traders are able to settle their one-time evaluation challenge fee using any of these methods.

- Credit/Debit Cards: Payments can be made instantly and securely using any Major credit or debit card.

- Cryptocurrency: Payments can also be made using common cryptocurrencies for those who prefer digital assets.

- Wise: Wise is also accepted for fee payment and offers low cost international transfers with favorable exchange rates.

Lark Funding does not currently accept fees paid using e-wallet services such as Neteller or Skrill.

Payout Requirements and Options by Lark Funding

Traders can begin requesting payouts through Lark Funding's system after successfully clearing their evaluations and completing the KYC process.

Overview of the payout process:

- Evaluation Completed: A contract is sent over through docusign and a KYC verification link is sent over with Veriff.

- Account Activation: Funded account credentials are provided 2-3 business days after post KYC and signing of the contract. This process is often completed quicker.

- Payout Request: Post the first trade, payouts can be requested via dashboard between day 7-30 dependent on the program.

- Minimum Payout: Account holders are required to maintain a minimum profit of $100 in order to request withdrawal.

Payouts are reviewed and processed within 3 business days, but many traders report receiving funds in under 24 hours. - Every payout in Lark Funding is processed individually and the trader is contacted regarding their preferred fund disbursement method which adds an extra layer of flexibility and transparency.

Countries Restricted by Lark Funding

The countries listed below are restricted by Lark Funding due to compliance policies and regulatory restrictions:

- Afghanistan

- Burundi

- Central African Republic

- Congo Republic

- Cuba

- Crimea

- Democratic Republic of Congo

- Eritrea

- Guinea

- Guinea-Bissau

- Iran

- Iraq

- Liberia

- Libya

- Myanmar

- North Korea

- Papua New Guinea

- Somalia

- Sudan

- South Sudan

- Syria

- Vanuatu

- Yemen

- Zimbabwe

Due to compliance and financial regulations, these traders do not have the option to buy or take part in any of Lark Funding’s programs.

Final Thoughts of Lark Funding Prop Firm

Lark Funding appears to be one of the more competitive prop trading firms out there. This is because it allows its traders to trade in Forex, indices, commodities, cryptocurrencies, and a whole lot of other assets. With scaling opportunities of up to $1 million, a profit split of 90% and raw spreads of up to 0.1 pips, Lark Funding is certainly one of the best out there for long term traders.

Lark Funding is a prop firm with something for everyone due to clearly defined trading rules, evaluation challenges, multiple trading instruments, sophisticated trading platforms, high leverage, and competitive trading conditions. Some types of trading such as high frequency, arbitrage, or news trading are not permitted which can be quite limiting for some traders.

Despite the restrictions, Lark Funding offers balanced trading experiences. They provide numerous trading opportunities while simultaneously employing risk management, consistent payout options, transparent funding instructions, and multiple funding guidelines, thus making it a suitable choice for prop traders who seek peace of mind and reliability.