FundedNext Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full FundedNext review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

3.8

3.8

FundedNext

Forex, Crypto, Indices, Commodities

AE

2022

CEO: Abdullah Jayed

cTrader

MetaTrader

Wire Transfer/ Bank Transfer

Deel

Crypto

Wise

Crypto

Credit/Debit Card

Liquidity Providers

Can a prop firm really offer up to 90% profit share, multi-platform support, and a $4 million scaling plan - all while letting you trade forex, crypto, indices, and commodities with flexible rules?

Welcome to the world of FundedNext - where the pitch sounds like a trader’s dream - but the rules? Well, you’ve got to play it smart.

Founded in the heart of the UAE and quietly expanding its footprint across Asia - especially Bangladesh - FundedNext has become a go to name in the global prop trading ecosystem. Their approach? Offer traders real capital in a simulated environment with strong emphasis on risk control, strategy based evaluations and genuine trading behavior.

In this 2025 detailed FundedNext review, we’ll break down everything: the challenge types, profit splits, payout timelines, trading rules, prohibited strategies (yes, they’re strict about it) and their popular scaling model that pushes traders toward multi-million dollar accounts. Whether you are eyeing the Stellar Lite, 1-Step, or Instant or just wondering if it's all too good to be true, this guide will give you the no-fluff answer.

Let’s start with the essentials.

FundedNext Prop Firm Overview (2025 Edition)

| Feature | Details |

|---|---|

| Company Name | FundedNext |

| Broker | FundedNext does not publicly disclose their associated broker partners |

| Company Legal Name | The Legal Name of FundedNext is GrowthNext F.Z.E. |

| CEO | The founder & CEO at FundedNext is Abdullah Jayed |

| Registration Number | The registration number of FundedNext firm is 28831 |

| Headquarters | FundedNext is headquartered at United Arab Emirates (UAE) |

| Operating Since | FundedNext started operation in March 2022 |

| Challenge Types | FundedNext offers Stellar 1-Step, 2-Step, Stellar Lite, Stellar Instant |

| Funding Models | FundedNext offers Evaluation & Instant |

| Challenge Fees | The Challenge Fees of FundingNext starts from $49 to $999 |

| Profit Split | FundedNext offers 80% to 95% profit Split |

| Account Sizes | FundedNext provides funded accounts ranging from $6,000 to $200,000 |

| Payouts | FundedNext offers weekly and bi-weekly payouts depending on the funded account type |

| Payout Method | USDT (TRC-20 Wallet) |

| Funding Model | FundedNext provides Virtual Capital with Real Payouts to traders |

| Financial Markets | FundedNext offers Forex, Indices, Commodities, Crypto instruments for trading |

| Trading Platforms | FundedNext supports MT4, MT5, cTrader, and Match-Trader platforms |

| Trading Environment | Simulated Environment - All trading is done in a demo environment with live market prices |

| TrustPilot Score | FundedNext has a 4.6 / 5 rating on Trustpilot |

Pros and Cons of Trading with FundedNext Prop Firm – Quick Comparison

If you have been scanning the prop firm space then you have likely bumped into FundedNext. And not without reason. With a flashy 95% profit share promise, four different challenge types and scaling up to $4 million - it’s easy to get starry eyed. But like any serious trading partner, FundedNext comes with its own list of “hell yes” features and a few things that might make cautious traders take a step back.

Here’s an honest breakdown of where FundedNext shines... and where it might test your patience.

Pros and Cons of Trading with FundedNext

| Pros | Cons |

|---|---|

| Up to 95% profit share, including 15% during Challenge phase | Strict strategy violation policies - quick bans for risky tactics |

| Four challenge types to suit every trading style | All accounts are simulated - no direct market exposure |

| Fast payout cycles (5 to 14 days) processed in USDT TRC-20 wallet | Commissions range from $5 to $7 per lot which is higher than some other prop firms |

| Supports multiple trading platforms - MT4, MT5, cTrader & Match-Trader | Copy trading is capped at $300K and limited to self-owned accounts |

| Simulated trading mirrors real-market conditions for learning safely | Scale up requires 4 months of consistent growth and 2 payouts |

| Scale up plan boosts capital by 40% every 4 months (up to $4M) | Evaluation & Express accounts closed for new clients post-March 2025 |

FundedNext Challenge Types, Fees, and Profit Split (2025)

Introduction: Which FundedNext Challenge Fits You?

Whether you are a patient strategy builder or an aggressive momentum chaser, FundedNext’s lineup of challenges offers something for every trading style. From the feature packed Stellar 2-Step to the high speed Stellar Instant - each account model is built to simulate real world conditions while rewarding disciplined traders with up to 95% profit split including 15% profit share during the challenge itself (an industry first).

With account sizes from $5K to $200K, flexible drawdown options, and refund on success pricing, FundedNext gives traders from over 170 countries a realistic path to grow their capital and earn consistent payouts. Let’s break them down.

FundedNext Challenge Comparison Table:

| Feature | Stellar 2-Step | Stellar 1-Step | Stellar Lite | Stellar Instant |

|---|---|---|---|---|

| Account Sizes | $6K - $200K | $6K - $200K | $5K - $200K | $5K - $20K |

| Fee Range | $59 - $1099 | $65 - $1099 | $32 - $798 | $195 - $780 |

| Profit Target | 8% (P1) / 5% (P2) | 10% Total | 8% (P1) / 4% (P2) | 6% Total |

| Max Position | No Limit | No Limit | No Limit | No Limit |

| Daily Loss Limit | 5% | 3% | 4% | None |

| Max Drawdown | 10% | 6% | 8% | 6% (Trailing) |

| Drawdown Type | Absolute | Absolute | Absolute | Trailing |

| Reset Fee | Free Retry | Free Retry | Free Retry | Not Available |

| Activation Fee | None | None | None | Included in Price |

| Micro Scaling | Yes | Yes | Yes | No |

| Scaling Rule | Yes (40% every 4M) | Yes | Yes | No |

| Consistency Rule | No | No | No | No |

| Payout Timeframe | 21 Days | 5 Days | 21 Days | 14 Days (On Demand) |

| Min Win Days Funded | 5 Days | 2 Days | 5 Days | None |

| Best For | Balanced Traders | Skilled Swing/Scalp | Budget Beginners | Instant Access |

Stellar 2-Step Challenge

What is Stellar 2-Step?

The Stellar 2-Step Challenge is FundedNext’s most balanced offering. With a two-phase evaluation process, it tests both consistency and discipline. Phase 1 requires an 8% gain; Phase 2 asks for 5%. Loss limits are generous, and you get 15% profit share even during the challenge, plus up to 95% after funding.

Key Parameters:

| Account Size | Profit Target (P1/P2) | Daily Loss Limit | Max Drawdown |

|---|---|---|---|

| $6,000 | 8% / 5% | $300 (5%) | $600 (10%) |

| $15,000 | 8% / 5% | $750 (5%) | $1,500 (10%) |

| $25,000 | 8% / 5% | $1,250 (5%) | $2,500 (10%) |

| $50,000 | 8% / 5% | $2,500 (5%) | $5,000 (10%) |

| $100,000 | 8% / 5% | $5,000 (5%) | $10,000 (10%) |

| $200,000 | 8% / 5% | $10,000 (5%) | $20,000 (10%) |

Why Choose Stellar 2-Step?

- Earn 15% profit even before funding.

- Great for traders with moderate risk appetite.

- Full refund once passed + scaling option.

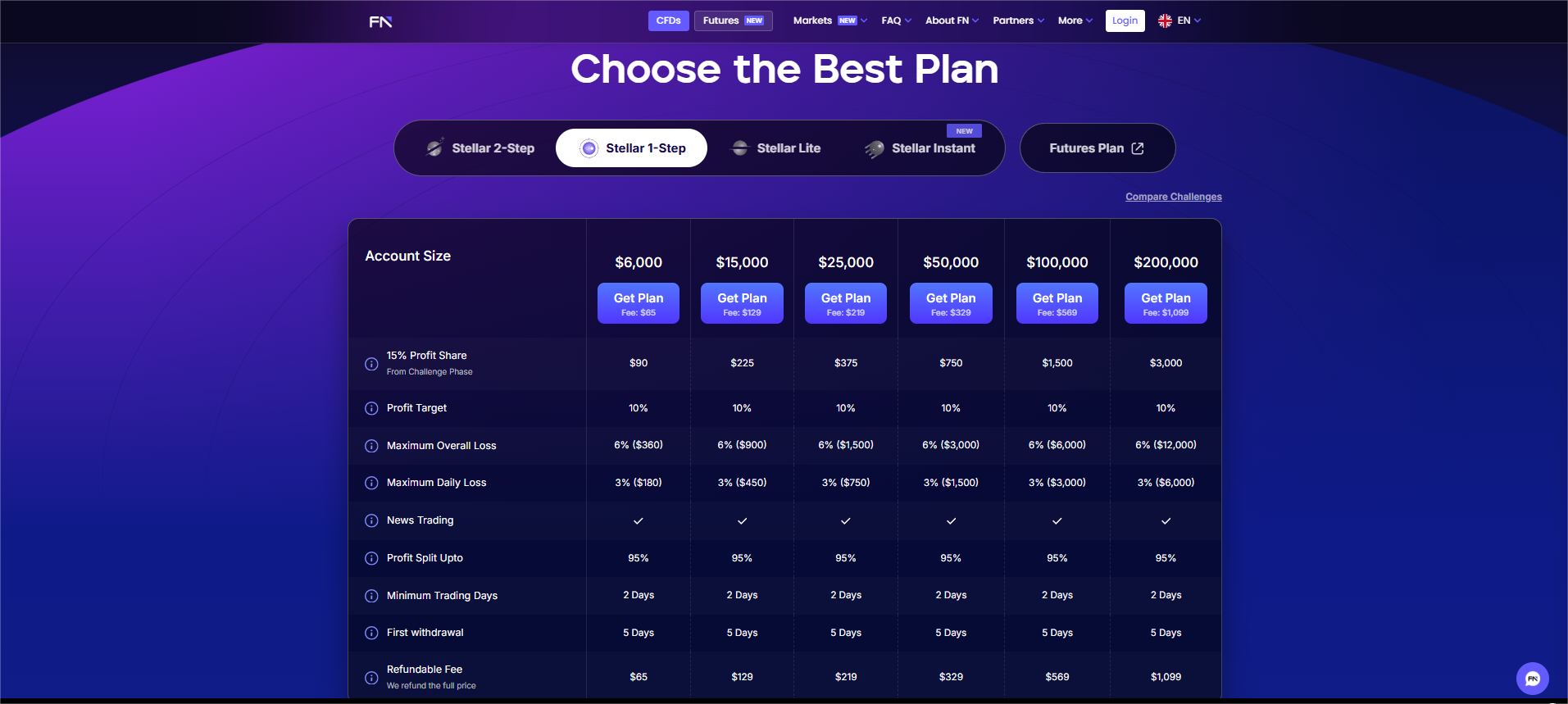

Stellar 1-Step Challenge

What is Stellar 1-Step?

For confident traders who want to skip the long haul, Stellar 1-Step offers a quicker evaluation with just a 10% profit target, tighter drawdowns, and fewer trading days required. Payouts come fast within 5 days.

Key Parameters

| Account Size | Profit Target | Daily Loss Limit | Max Drawdown |

|---|---|---|---|

| $6,000 | 10% | $180 (3%) | $360 (6%) |

| $15,000 | 10% | $450 (3%) | $900 (6%) |

| $25,000 | 10% | $750 (3%) | $1,500 (6%) |

| $50,000 | 10% | $1,500 (3%) | $3,000 (6%) |

| $100,000 | 10% | $3,000 (3%) | $6,000 (6%) |

| $200,000 | 10% | $6,000 (3%) | $12,000 (6%) |

Why Choose Stellar 1-Step?

- Fast payouts within 5 days.

- Fewer trading days required (2 days only).

- Ideal for experienced swing/scalp traders.

Stellar Lite Challenge

What is Stellar Lite?

If you’re just getting started or want a low-risk test of your strategy, Stellar Lite gives you all the essentials at the lowest cost. With bi-weekly payouts, this model is light on risk but serious about reward.

Key Parameters

| Account Size | Profit Target (P1/P2) | Daily Loss Limit | Max Drawdown |

|---|---|---|---|

| $5,000 | 8% / 4% | $200 (4%) | $400 (8%) |

| $10,000 | 8% / 4% | $400 (4%) | $800 (8%) |

| $25,000 | 8% / 4% | $1,000 (4%) | $2,000 (8%) |

| $50,000 | 8% / 4% | $2,000 (4%) | $4,000 (8%) |

| $100,000 | 8% / 4% | $4,000 (4%) | $8,000 (8%) |

| $200,000 | 8% / 4% | $8,000 (4%) | $16,000 (8%) |

Why Choose Stellar Lite?

- Most affordable path to get funded.

- Great for strategy testing and new traders.

- Includes bi-weekly payout option.

Stellar Instant Challenge

What is Stellar Instant?

No phases. No challenges. Just instant access to a funded account. Stellar Instant is built for seasoned traders who know they’re ready to perform. It comes with a 6% trailing drawdown and on-demand payouts, but unlike others, it does not refund the fee.

Key Parameters

| Account Size | Max Drawdown |

|---|---|

| $5,000 | $300 (6%, Trailing) |

| $10,000 | $600 (6%, Trailing) |

| $20,000 | $1,200 (6%, Trailing) |

Why Choose Stellar Instant?

- No evaluation - you can start trading from Day 1.

- Ideal for pros with a solid track record.

- Fastest payouts with no minimum trade days.

Our Review on FundedNext Challenges (2025)

FundedNext has created a rare balance of accessibility, scalability, and real-world realism. The 15% profit share during evaluation is unheard of in the prop trading space and puts real earnings in traders’ hands even before they’re officially funded.

Whether you’re just starting out with a $32 Stellar Lite account or jumping straight into action with Stellar Instant, FundedNext’s challenges are designed to reward skill, not luck. Add their multi-platform support and generous scaling plan into the mix, and you've got one of the most flexible prop firm ecosystems in 2025.

FundedNext Scaling Plan (2025)

So, you have passed the challenge, proven your strategy works and landed your funded account. What next?

At FundedNext, the journey doesn't stop with just staying funded it levels up. Their Scale Up Plan is a major incentive for disciplined traders - offering the chance to grow your account balance up to a whopping $4 million. But it's not handed out freely - you have got to earn it.

This scaling program is designed for traders who show consistent performance, proper risk control, and profitability over time. Whether you're using a Stellar, Stellar Lite, or even one of the legacy Evaluation or Express accounts, FundedNext reviews your progress every 4 months to determine if you are ready for more capital.

Let’s break down how it works.

FundedNext Scaling Plan Criteria

| Criteria | Requirement |

|---|---|

| Minimum Duration | 4 Consecutive Months of Trading |

| Cumulative Growth | At least 10% account growth across the 4 months |

| Payouts | At least 2 payouts received during those months |

| Last Month Profit | The final trading cycle must end in profit |

| Account Types Eligible | Stellar, Stellar Lite, Evaluation (legacy), Express (legacy) |

| Scale-Up Bonus | +40% Increase in Trading Capital |

| Maximum Capital Allocation | Up to $4 Million USD |

Sample Scaling Scenario

| Month | Starting Balance | Ending Balance | Cycle Growth |

|---|---|---|---|

| Jan | $100,000 | $103,000 | +3% |

| Feb | $103,000 | $99,000 | -1% |

| Mar | $99,000 | $105,000 | +5% |

| Apr | $105,000 | $103,000 | +3% |

| Total | +11% |

If at least 2 payouts were received and April ended in profit then this trader qualifies for a +40% capital boost → new account balance: $140,000

New Rules Post Scaling of your FundedNext Account:

- Daily Loss Limit: 5% of $140K = $7,000 (or 4% = $5,600 in Stellar Lite)

- Overall Loss Limit: 10% of $140K = $14,000 (or 8% = $11,200 in Stellar Lite)

- Next Target: +10% on $140K within the next 4 months

Important Notes for Traders

- You must close all trades before requesting a review. Contact support before trading in a new cycle.

- If your last cycle ends in a loss, even with +10% overall growth, you’ll have to wait another full 4-month cycle.

- The Express and Evaluation accounts have been discontinued for new clients (as of March 18, 2025), but existing users can still benefit from scaling.

Our Review: Is FundedNext’s Scaling Plan Worth It?

In one word: Absolutely.

FundedNext’s Scale Up system isn't just another marketing scheme rather it is a realistic growth pathway for serious traders. Unlike some prop firms that inflate scaling promises and rarely deliver, FundedNext puts performance first and rewards it with actual capital and higher limits. The +40% jump in capital every 4 months (if eligible) adds a motivational layer for traders focused on longevity rather than luck.

We particularly love that this plan is:

- Structured but forgiving - you only need two payouts and don’t have to win every month.

- Transparent - rules are clearly defined with no hidden traps.

- Scalable - $4 million is no joke, and the capital boost is real.

However, traders must stay mindful of the "last cycle must be profitable" rule. One bad month even after three good ones can delay your account scale-up - which can be frustrating.

If you are a patient, skilled and rules first trader, FundedNext's scaling plan could turn your $100K funded account into a $1M+ capital powerhouse in just a few cycles. That’s a deal few other firms can match in 2025.

FundedNext Spreads & Commissions What You Really Pay

If you are tired of getting blindsided by hidden fees or random spreads, FundedNext will feel like a breath of fresh air. They have made it clear from the start that trading here is meant to feel as close to the real market as possible, without all the usual prop firm confusion.

Let us start with spreads. FundedNext offers spreads starting as low as 0.0 pips, depending on the asset and market conditions. In fact, many traders say their spreads are even better than what you get with standard ECN accounts. If you want to double-check them live, you can log in to their MT4 or MT5 platforms using demo credentials and view spreads in real time.

Now, let us talk commissions. Yes, there is a cost to every trade but it is fair and clearly laid out. Here is how it breaks down depending on your account type:

Stellar 1-Step & 2-Step Accounts:

- Forex: $5 per lot (round trip)

- Commodities: $5 per lot

- Indices: $0 (yes, zero!)

- Crypto: 0.04% per lot

Stellar Lite Account:

- Forex: $7 per lot

- Commodities: $7 per lot

- Indices: Still $0

- Crypto: Same 0.04% per lot

That crypto fee might sound a bit confusing at first. But here is a quick example to clear it up:

Let us say you open a 1-lot ETH/USD trade at 2722.12. Your commission would be:1 x 2722.12 x 0.04% = $1.08

So, in that case, you’d only pay $1.08 in commission super reasonable.

What is nice is that these fees are always applied transparently during your trades, so there are no surprises after you click the button. You will see exactly where your money’s going.

In short, FundedNext gives you tight spreads, low trading costs, and a no-nonsense fee structure. Whether you are scalping forex or swinging crypto, they have built a cost model that respects traders and does not chip away at your profits behind the scenes.

Drawdown Rules at FundedNext: Simple Breakdown for Every Trader

Managing risk is everything in trading and FundedNext takes this seriously. That is why they have set up clear drawdown rules to help you trade smarter, not harder. Two important limits you will deal with here are the Daily Loss Limit and the Overall Loss Limit. Let us walk through what those really mean in everyday trader terms.

What is the Daily Loss Limit?

Think of this as your “daily stop sign.” It’s the maximum amount you are allowed to lose in a single trading day. The limit resets every midnight (based on the platform’s server time), and it depends on the challenge account type you chose:

- Stellar 2-Step Account → 5% of your starting balance

- Stellar 1-Step Account → 3%

- Stellar Lite Account → 4%

For example, let us say you have a $100,000 Stellar 2-Step account. Your max daily loss is $5,000. Now imagine you are having a great morning and you are up $2,000 your new daily limit for that day bumps up to $7,000 ($5,000 original limit + $2,000 profit). But if you cross that line whether from closed trades, floating losses, or even fees your account will get paused. No more trades for that day until you reset.

Important: The reset does not happen automatically if breached you’ll need to manually reset your challenge account.

What is the Overall Loss Limit?

Now this one is your “total safety net.” It’s the biggest loss you can take during your entire challenge or funded journey. If your account balance (including floating losses) drops below this limit, your account is considered breached, and it won’t continue.Here is how the Overall Loss Limit is set:

- Stellar 2-Step → 10% loss allowed

- Stellar 1-Step → 6% loss allowed

- Stellar Lite → 8% loss allowed

So for that same $100,000 account in the 2-Step Challenge, your lowest allowed balance is $90,000. If you go below that even just for a moment your challenge ends.What is cool though is that if you make profits during the challenge, your loss limit increases too. For instance, if you have made $4,000 profit, your total room for loss grows to $14,000 ($10K original + $4K profit). That’s extra breathing space for smart traders.

What Happens If You Break a Limit?

If you hit your daily limit, your account gets paused for the day no trades until you reset. But if you hit the overall loss limit, your challenge is over. You’ll need to purchase a new challenge account to try again.

And yes, these rules apply just as strictly to funded accounts too. Break a limit there? You will need to restart your journey.

Do These Limits Grow With My Account?

Yes, they do. If your account scales up say you double your capital then your drawdown limits grow too. FundedNext adjusts your loss limits to match your new balance, so the same percentage applies but with higher dollar values. That keeps risk control consistent as your account grows.

Why Does FundedNext Set These Rules?

The goal is to protect you and the firm. The Daily Loss Limit stops traders from spiraling out in a single bad session. The Overall Loss Limit protects from blowing up the account altogether. These are not punishments they are guardrails to help you trade more responsibly.If you are serious about trading like a pro, these rules will feel like a good challenge, not a roadblock. Know your limits, trade within them, and grow from there.

FundedNext Trading Rules (2025) What is Allowed and What is Not

So, if you are trading with FundedNext or thinking about it? Great. But before you click “Buy” or “Sell,” it is crucial to understand what FundedNext actually allows and more importantly, what it does not allow. They are not playing around when it comes to trading rules, and if you are not careful, even an honest mistake can cost you your funded account.

Prohibited Trading Strategies at FundedNext

1. Abusing the Challenge System

Some folks think they are slick creating strategies that work only on demo accounts to pass the challenge and then switch up everything on the real one. FundedNext sees right through that. If you are trying to "game" the challenge with unrealistic, no risk tactics that would never survive in real market conditions, your account will be shut down. No warning. No payout.

Real talk: Treat your challenge like a real money account. If it only works on demo, it is not a strategy it is a loophole.

2. Gambling Behavior

Trading like you are at a roulette table? That is a one way ticket to getting banned. If you are risking 70%+ of your margin in one go or throwing random trades without logic, FundedNext considers that gambling. Responsible traders usually risk 1% or less per trade and keep margin usage below 30%.

What happens if you gamble?

First, you will get a warning.

If you ignore it, your leverage might be reduced or capped at a 1% risk.

Keep pushing it? Your account gets terminated.

3. Quick Strike Method

This is when you try to make money by placing ultra fast trades lasting a few seconds. Yes, it sounds smart in theory. But in reality, it messes with the platform, creates fake volume, and distorts price data. FundedNext does not tolerate it.

4. High-Frequency Trading (HFT)

This is the “machine gun” approach executing hundreds or thousands of trades in milliseconds using bots or EAs. It not only floods the system but can mislead other traders with fake market moves.

If FundedNext detects HFT, even once, you are at risk of a serious ban or leverage cut. And if your trades freeze the server? They might skip warnings altogether and shut you down instantly.

5. Copy Trading (With Others)

You can copy trades between your own FundedNext Challenge accounts but only if you own all of them and stay under a $300K cap.

What is not allowed?

- Copying trades from other people.

- Using third-party cloud copy software (like Social Trader Tools).

- Participating in “pass my challenge” services.

- Managing someone else’s account or copying their’s even if it is your cousin.

6. Hedging Between Accounts

Hedging is fine only if it is done within one account. But if you hedge across two accounts (buy on one, sell on another), FundedNext flags it as manipulation.

Example: Buy EUR/USD on Account A and sell it on Account B = Not allowed.

7. Arbitrage Trading

If your strategy relies on exploiting price lags or differences across platforms to secure “risk-free” profits, that is arbitrage and FundedNext does not allow it. It is considered unfair and manipulative.

8. Tick Scalping

Taking advantage of tiny, rapid movements (a few ticks) with dozens of trades per minute? That is tick scalping. It creates unfair market pressure and liquidity problems. FundedNext limits it heavily or bans it outright.

9. Grid Trading

Placing multiple buy/sell orders at different levels to profit from bounces? That is grid trading. Sounds clever, but one big move in the wrong direction can nuke the entire strategy. FundedNext says no to this one too it is risky and manipulative.

10. Latency Exploits

If you are trying to gain an edge by exploiting slow server responses or market feed delays, don’t. This is strictly banned, and using any trick to take advantage of data freezing or server lag will result in an account shutdown.

11. Account Rolling

This one is sneaky. Buying 5 to 10 cheap evaluation accounts and treating them like lottery tickets sacrificing a few and hoping one wins? That is account rolling. FundedNext actively monitors and punishes this. It is not strategy it is gambling dressed as “creative risk management.”

12. One-Sided Betting

Placing massive positions only in one direction (all buys or all sells) without doing real analysis? That is called one-sided betting. FundedNext considers it a red flag. If you are not backing up trades with logic, don’t be surprised if they shut it down.

13. Hyperactivity (Too Many Trades)

Over-trading is another problem. If you are pushing 200+ trades or 2,000+ server messages a day (including stop loss and TP changes), you will get a warning. Hit 15,000 in a day? Your account might get disabled on the spot.

Warnings are shared across all your accounts, so don't think opening a new one resets the score.

14. Using Server Bugs or Freezes

If the demo server lags and you use that glitch to your advantage like slipping in orders during a freeze FundedNext will catch it. It is not clever; it’s cheating. Report bugs, don’t exploit them.

15. Low-Liquidity Manipulation

Trading during dead market hours (like between US and Asia sessions) to guarantee profitable fills? That’s also banned. It breaks the integrity of pricing and creates fake market moves.

16. Account or Device Sharing

Using someone else’s device to trade? Sharing your login with your cousin or teammate? Don’t. FundedNext has a zero-tolerance policy on this. Even if the trades are good, the violation will get your account revoked.

What Is Allowed at FundedNext?

To be fair, FundedNext is not anti-trader. They allow:

- Regular trading, even during news events (with some profit split rules on funded accounts).

- Copy trading between your own Challenge Accounts under $300K.

- Hedging within the same account.

- Manual or VPS-based trade copying (within your own accounts only).

- News trading (as long as you understand the 40% news profit rule on Funded accounts).

Our review on FundedNext Trading Rules

FundedNext is not trying to trap traders they are trying to protect the integrity of the platform for everyone. The rules are there to prevent exploitation and ensure that those who succeed are actually good traders, not just lucky or sneaky.

Want to pass your challenge and get funded? Stick to real, responsible trading. No loopholes. No gambling. Just skill, patience, and solid risk management.

Trading Instruments Offered by FundedNext

FundedNext provides access to a diverse portfolio of global assets, allowing traders to strategize and market-session diversifiy across various sessions and prop strategies.

Instruments List with Descriptions

- Forex: Trade all major, minor and exotic currency pairs with leverage up to 1:100, and razor-thin spreads.

- Indices: Other indices include S & P 500, NASDAQ, Dow Jones, DAX etc. dynamically leveraged and low latency.

- Commodities: Gold, Silver, Brent and WTI all offered with deep liquidity and raw execution.

- Cryptocurrencies: BTC, ETH, SOL, ADA, XRP—Around-the-clock trading without fees and vast liquidity.

Our Review on Instruments

FundedNext has competitive trade execution and leverage and strong diversity in asset classes. FundedNext traders have access to raw spreads and quick fills for major and minor Forex pairs, global indices, and popular commodities. The addition of crypto trading around the clock and algorithmic trading support increases the edge of FundedNext for macro and intraday traders. FundedNext can accommodate both swing traders and scalpers by providing the required platform stability and asset class coverage to execute advanced trading strategies in all market conditions.

Payment Options and Payout Requirements

FundedNext offers both crypto and fiat payment options that are secure and fast.

FundedNext supports payments via Crypto, Credit/Debit Card. FundedNext facilitates withdrawals through Wire Transfer/ Bank Transfer, Deel, Crypto, Wise.

Country Restrictions

FundedNext blocks access in certain areas due to compliance regulations.

Estranged Countries List (with flags)

- USA 🇺🇸

- Iran 🇮🇷

- North Korea 🇰🇵

- Russia 🇷🇺

- Cuba 🇨🇺

- Belarus

- Syria 🇸🇾

- Venezuela 🇻🇪

- Sudan 🇸🇩 Sent

- Myanmar 🇲🇲

- Crimea (Ukraine) 🇺🇦

“Dealers from these regions are barred from selling or engaging in FundedNext’s programs due to legal and monetary compliance underwriting policies.”

Our Concluding Remarks For FundedNext

In the years 2025, FundedNext appears to be one of the most trusted proprietary trading firms because of the real payouts they issue from day one, generous scaling (up to $4 million), and one of the most flexible prop trading funding structures in the industry. FundedNext has managed to cement a strong reputation in the funded trader space with bi-weekly payout cycles, an actual capital experience even during evaluations, multiple challenge models tailored to different trader personas, and a myriad of funded trader evaluations.

Whether you are a swing trader, scalper, or an EA developer, FundedNext caters to all with its professional-grade platform that allows algorithmic trading and copy trading across multiple accounts. Along with clear guidelines, low trading fees, and speedy onboarding, FundedNext continues to be the preferred option for traders seeking to consistently scale their accounts with a prop firm that values performance. If you’re in search of a prop firm that provides opportunities while ensuring there is accountability, FundedNext is one of the best available today when it comes to funded accounts.