Blue Guardian Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Blue Guardian review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.3

4.3

Blue Guardian

Forex, Indices, Metals, Commodities, Crypto

AE

2021

CEO: Sean Bainton

Get 40% OFF on All Blue Guardian Accounts

Coupon Code:

Metatrader 5

MatchTrader

Trade Locker

Crypto

Rise

Credit/Debit Card

Crypto

MatchTrader

TradeLocker

Try Our New Consistency Calculator

Advanced analytics to measure your trading edge and performance consistency

Blue Guardian Review 2026

Blue Guardian is a forex and crypto-focused prop firm offering simulated funded account programs for retail traders who are seeking funded capital, trading opportunities. In this Blue Guardian Review 2026, we analyzes the firm’s challenge models, prop firm rules, drawdown structure and payout system in detail to help traders compare and choose the right funded account.

This prop firm may suit consistent day traders and swing traders who are looking for flexible evaluation options and scaling up to $400,000 in simulated capital. However, traders should carefully review and understand the drawdown rules and consistency requirements before choosing a Blue Guardian account type.

Blue Guardian Prop Firm Overview

The following information is compiled from the official website of Blue Guardian, public disclosures, and available trader feedback as of 2026.

| Category | Details |

|---|---|

| Company Name | The prop firm name is Blue Guardian. |

| Legal Name | Blue Guardian's legal name is Iconic Exchange FZCO (formerly Iconic Exchange Limited). |

| Registration Number | Blue Guardian's registration number is DSO-FZCO-17798 (Dubai Silicon Oasis) or 12087566 (UK entity). |

| CEO | The CEO of Blue Guardian is Sean Bainton. |

| Headquarters | The headquarters is located at Dubai Silicon Oasis, UAE. |

| Broker | The broker associated with Blue Guardian is ThinkMarkets (serving as an Introducing Broker). |

| Operating Since | Blue Guardian has been operating since September 2021. |

| Account Sizes | Blue Guardian provides account sizes ranging from $5,000 up to $400,000. |

| Profit Split | Blue Guardian offers up to 90% profit split (starting at 80%). |

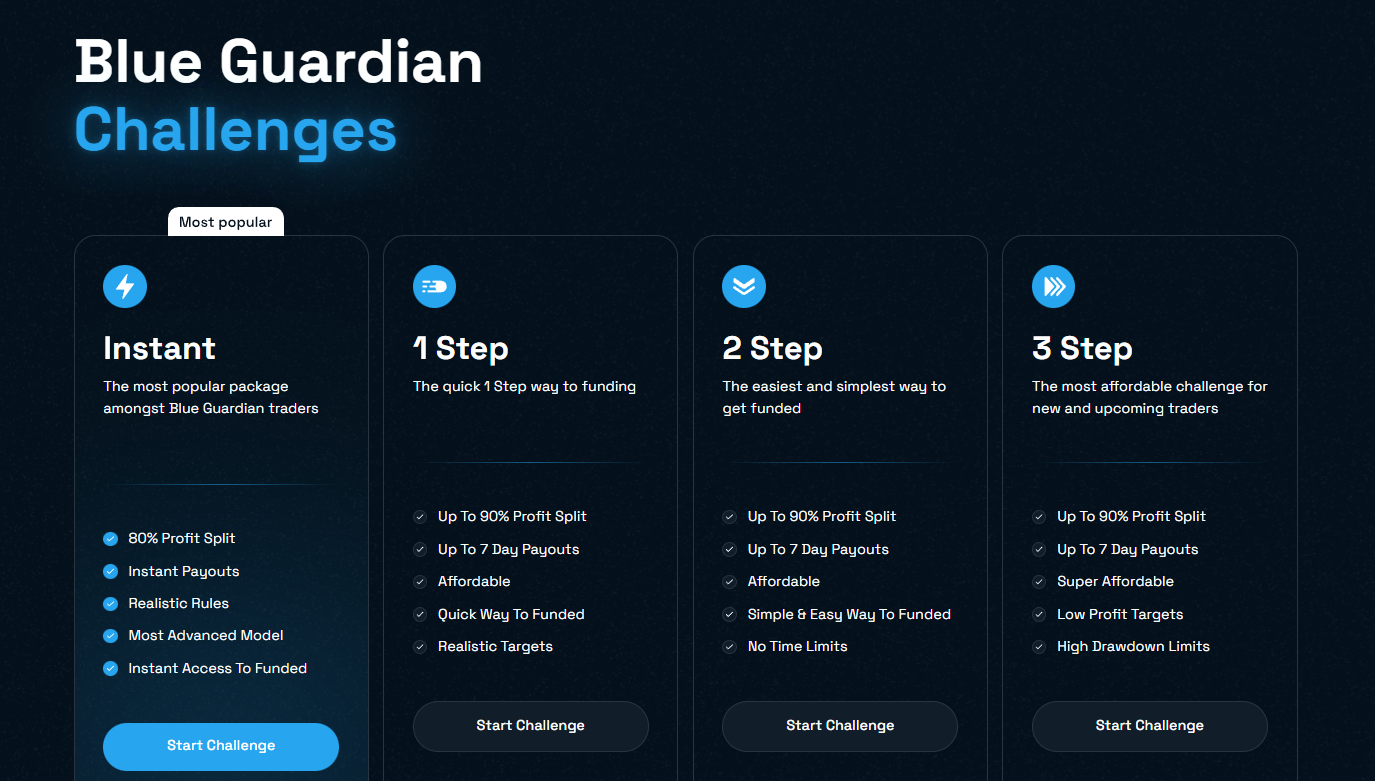

| Challenge Types | Blue Guardian offers Instant Funded account, 1-Step, 2-Step and 3-Step challenges. And also Crypto account type. |

| Payout Cycle | Blue Guardian offers payouts bi-weekly (default) or weekly (as an add-on). For the Instant account, traders get instant, on-demand payouts. |

| Payout Method | The profit withdrawal methods supported by Blue Guardian are Bank Transfer (via Rise/Deel) and Cryptocurrency. |

| Trading Platforms | Blue Guardian supports trading on MetaTrader 4 (MT4), MetaTrader 5 (MT5) and DXTrade trading platforms. |

| Financial Markets | Blue Guardian supports trading in Forex, Indices, Commodities and Cryptocurrencies. |

| Max Allocation | Blue Guardian offers a maximum allocation of $400,000 (total initial capital across accounts). |

| Max Scaling | Blue Guardian provides scaling opportunities up to $4M. |

| Trustpilot Score | Blue Guardian has over 2,000+ reviews with 70% of positive responses by traders as of Feb 2026. |

Pros and Cons of Trading with Blue Guardian

In this Blue Guardian review 2026, we carefully examined the firm’s prop firm rules, drawdown limits, how its profit split structure works across different account type and overall trader flexibility. While Blue Guardian positions itself as a trader friendly prop firm, certain account models include specific rule conditions that traders must understand before purchasing a challenge.

| Pros | Cons |

|---|---|

| Guardian Shield auto-equity protection. It is an exclusive equity protection tool that closes trade automatically while it cross your loss limit. | 25% of consistency rule applies to Blue Guardian 2 Step Pro funded stage only. Consistency rule does not apply during evaluation phase. |

| No time limits on any challenge type | Trailing drawdown on Pro and Instant accounts. Which might be constraint for traders who are used to static drawdown. |

| Zero minimum trading days on Pro accounts | News trading restrictions on Instant Standard accounts – limits traders who are news enthusiast and want Instant Funding |

| Competitive $27 entry for Starter accounts | Higher relative cost for 1-Step Pro options |

| Raw spreads and low commission structures | Limited maximum allocation on challenge and crypto accounts compared to Instant accounts having up to $400k capital access. |

Overall, Blue Guardian presents a structured yet flexible prop firm environment for trading. Although some accounts come with trailing drawdown rules that necessitate very disciplined risk management, Blue Guardians well-articulated payout structure and trading account safeguarded by an automatic equity protection system could appeal to those structured traders who like to have their rules very clear.

It is advisable that traders assess the limits on drawdown, restrictions that are specific to a particular account and conditions of consistency very thoroughly before making a decision to pick a model. One must clearly comprehend the interplay of these prop firm rules with the type of trading that is one's style so as to achieve sustainability in the long run of a funded account.

Blue Guardian Account Types, Fees & Profit Split Explained (2026)

Blue Guardian is a crypto prop firm that provides a range of challenge and funded accounts to cover every risk profile from the reserved "3-Step challenge" to the fastest funded account, "Instant Funding" model. Understanding account structure is important for traders - as fees, drawdown type, profit targets and trading rules during both the challenge and funded phase can directly impact their long term profitability.

The Blue Guardian account fee structure is relatively straightforward with refundable fees and no time limits on the challenge accounts. Traders should carefully evaluate drawdown rules and payout conditions before selecting a prop firm model - as these rules ultimately determine the long term sustainability. Below is a quick breakdown of Blue Guardian account types to help traders compare options based on strategy, risk tolerance and their goals.

Blue Guardian Account Types comparison

The following information is compiled from the official website of Blue Guardian.

| Feature | 1-Step (Standard/Pro) | 2-Step (Standard/Pro) | 3-Step Challenge | Instant (Starter/Standard) | Crypto | Guardian X |

|---|---|---|---|---|---|---|

| Account Sizes | $5k - $200k / $5K - $100K | $5k - $200k | $5k - $200k | $5k only for Starter $5k - $400k for Standard Instant | $5K - $100K | $5K - $100K |

| Account Fees | $70 / $87 | $49 / $36 | $30 | $27 / $109 | $70 | $92 |

| Profit Target | 10% | 8% (P1), 4% (P2) Standard 10% (P1), 4% (P2) Pro | 6% / 6% / 6% | None | 10% | 3% |

| Daily Drawdown | 4% | 4% | 4% | 3% | 3% | 3% |

| Max Drawdown | 6% Trailing (Std) / 6% Static (Pro) | 8% (Std) / 10% (Pro) | 8% (Static) | 5% (Start) / 6% (Std) | 6% | 5% |

| Drawdown Type | Static or Trailing | Static or Trailing | Static | Trailing | Trailing | Trailing |

| Min. Trading Days | 3 Days | 5 Days for Standard / 4 Days for Pro | 3 Days | 5 Days | 3 Days | 5 Days |

| Max Trading Days | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Leverage | 1:100 – 1:50 / 1:20 (Both Phase) | 1:50 (Std / Pro) | 1:100 | 1:30 | 1:4 | 1:30 |

| Stop Loss Rule | Not Required | Not Required | Not Required | Not Required | Not Required | Not Required |

| Consistency Rule | No | No. But, only applies to Pro funded stage | No | 20% | No | 20% |

| News Trading | Allowed | Allowed | Allowed | Allowed on Starter, Restricted on Standard | Allowed | Allowed |

| Profit Split | 80% - 90% | 80% - 90% | 80% - 90% | 80% - 90% | 80% - 90% | 80% - 90% |

| Payout Frequency | 14 Days or 7 Days with add-on | 14 Days or 7 Days with add-on | 14 Days or 7 Days with add-on | 14 Days or 7 Days with add-on | 14 Days or 7 Days with add-on | 14 Days or 7 Days with add-on |

Blue Guardian frequently offers discount codes on both challenge and funded accounts which helps traders to reduce upfront evaluation costs. Reviewing these account variations carefully allows traders to choose a structure aligned with their risk tolerance and trading strategy. Below are the section of Blue Guardian Challenges and Instant Funding account types, that explained in detailed.

Blue Guardian 1-Step Standard / Pro Challenge

The Blue Guardian 1-Step evaluation is designed for confident traders who want a faster route to funding. Instead of multiple phases, traders only need to prove consistency and profitability in a single evaluation stage and traders get 2 variant options to choose from. The 1-Step Standard provides a balanced environment with a trailing drawdown that rewards steady growth. Meanwhile, the 1-Step Pro simplifies the process even further by removing minimum trading day requirements, allowing experienced traders to get funded purely based on performance rather than time. However, traders should be aware that the 6% total drawdown limit - especially under trailing conditions - can tighten quickly if early profits are not secured properly.

Below is a quick breakdown of Blue Guardian 1-Step challenge standard and pro account rules to pass evaluation:

| Account Size | Account Fee (Std/Pro) | Profit Target ($) (10%) | Max Daily Drawdown ($) (4%) | Max Total Drawdown (Std Trailing 6% / Pro Static 6%) |

|---|---|---|---|---|

| $5,000 | $70 / $87 | $500 | $200 | $300 |

| $10,000 | $87 / $110 | $1,000 | $400 | $600 |

| $25,000 | $177 / $210 | $2,500 | $1,000 | $1,500 |

| $50,000 | $277 / $320 | $5,000 | $2,000 | $3,000 |

| $100,000 | $477 / $540 | $10,000 | $4,000 | $6,000 |

| $200,000 | $927 / $1,050 | $20,000 | $8,000 | $12,000 |

Why Choose Blue Guardian 1-Step Standard / Pro Challenge?

- Speed of Execution: Faster evaluation completion possible under the Pro model due to zero minimum trading days.

- Generous Pro Limits: The Blue Guardian 1-Step Pro challenge offers a huge 10% total drawdown, which is comparatively higher than many single-phase prop firm evaluations.

- One-Time Hurdle: Get rid of the ordeal of multiple evaluation phases and still get a 90% profit split.

Blue Guardian 2-Step Standard / Pro Challenge

The Blue Guardian 2-Step challenge is designed to reward consistency by splitting the evaluation into two simple profit targets, making it an ideal choice for conservative traders seeking higher overall drawdown limits than the 1-Step model. By progressing through two stages, traders can demonstrate disciplined risk management and steady performance before reaching a funded account. The Standard 2-Step offers a reliable, static drawdown structure for those prioritizing capital safety, while the 2-Step Pro rewards efficiency by removing minimum trading day requirements. Main risk in the 2-Step model lies in maintaining discipline across both phases - as over aggressive trading in Phase 1 can reduce trade flexibility in Phase 2.

Below is a structured breakdown of Blue Guardian 2-Step challenge standard and pro account rules to pass evaluation:

| Account Size | Account Fee | Profit Target (Std - 8%, 4% / Pro - 10%, 4%) | Max Daily Drawdown ($) (4%) | Max Total Drawdown (8% Static Std / 10% Trailing Pro) |

|---|---|---|---|---|

| $5,000 | $49 / $36 | $400, $200 / $500, $200 / | $200 | $400 / $500 |

| $10,000 | $112 / $79 | $800, $400 / $1,000, $400 | $400 | $800 / $1,000 |

| $25,000 | $229 / $111 | $2,000, $1,000 / $2,500, $1,000 | $1,000 | $2,000 / $2,500 |

| $50,000 | $345 / $250 | $4,000, $2,000 / $5,000, $2,000 | $2,000 | $4,000 / $5,000 |

| $100,000 | $579 / $464 | $8,000, $4,000 / $10,000, $4,000 | $4,000 | $8,000 / $10,000 |

| $200,000 | $1,162 / $921 | $16,000, $8,000 / $20,000, $8,000 | $8,000 | $16,000 / $20,000 |

Why Choose Blue Guardian 2-Step Standard / Pro Challenge?

- Less Pressure on Phase 2: After you successfully pass the first phase, the target becomes an easily reachable 4% for continuous confirmation.

- Bigger Safety Margin: The total drawdown of 8% to 10% gives you more flexibility if you want to swing trade or if the market gets quite volatile.

- Pro Flexibility: Just like Blue Guardian 1-Step challenge, the 2-Step Pro eliminates minimum trading days thus efficient traders get rewarded.

Blue Guardian 3-Step Challenge

Instead of aiming for a large profit target in one phase, the Blue Guardian 3-Step Challenge divides the risk into three phases, each with an achievable 6% profit target. This structure helps reduce psychological pressure and allows traders to focus on consistency and risk control over time, making it especially suitable for disciplined, long-term traders. The main risk in 3-step challenge is the drawdown pressure across three phases - which requires consistent capital management from traders. The Blue Guardian 3-Step Challenge is mostly built for traders who prefer a slower, more controlled path to funding.

Below is a simplified breakdown of Blue Guardian 3-Step challenge rules to pass evaluation:

| Account Size | Account Fee | Profit Target (6% per Phase) | Max Daily Drawdown ($) (4%) | Max Total Drawdown ($) (8%) |

|---|---|---|---|---|

| $5,000 | $30 | $300 | $200 | $400 |

| $10,000 | $67 | $600 | $400 | $800 |

| $25,000 | $147 | $1,500 | $1,000 | $2,000 |

| $50,000 | $227 | $3,000 | $2,000 | $4,000 |

| $100,000 | $367 | $6,000 | $4,000 | $8,000 |

| $200,000 | $667 | $12,000 | $8,000 | $16,000 |

Why Choose Blue Guardian 3-Step Challenge?

- Budget Friendly: With the lowest entry fees, it allows the traders to get six-figure capital at a very low initial investment.

- Low-Stress Targets: 4% targets can be reached considerably easier without over-leveraging, the traders are more likely to adopt the right trading habits.

- Static Drawdown: A single 8% drawdown level (not trailing) makes risk management computations easier and more reliable.

Blue Guardian Instant Funding (Starter & Standard) Model

The Blue Guardian’s Instant Funding model allows traders to skip traditional evaluation phases and start earning profit share from the very first day. Instead of meeting profit targets, traders are funded immediately and trade under predefined drawdown limits.

A notable addition within this model is the $5,000 Starter account which is priced at just $27, offering a low risk way to experience Blue Guardian’s trading conditions before committing to larger account sizes. Traders must also note that the primary risk is the absence of a profit buffer during evaluation which means drawdown breaches lead to immediate account closure.

Below is a simplified overview of Blue Guardian Instant Funding account rules in the funded phase:

| Account Size | Account Fee (Std / Starter only for $5K) | Profit Target ($) | Max Daily Drawdown ($) (3%) | Max Total Drawdown ($) (6%) |

|---|---|---|---|---|

| $5,000 | $109(Standard) $27 (Starter) | None | $150 | $300 |

| $10,000 | $149 (Standard) | None | $300 | $600 |

| $25,000 | $309 (Standard) | None | $750 | $1,500 |

| $50,000 | $479 (Standard) | None | $1,500 | $3,000 |

| $100,000 | $779 (Standard) | None | $3,000 | $6,000 |

| $200,000 | $1,195 (Standard) | None | $6,000 | $12,000 |

| $300,000 | $2,140 (Standard) | None | $9,000 | $18,000 |

| $400,000 | $2,752 (Standard) | None | $12,000 | $24,000 |

Why Choose Blue Guardian Instant Funding Model?

- Immediate Earning: Traders begin operating under funded conditions from day one, subject to drawdown and consistency rules.

- Zero Profit Targets: There is no passing score - you may keep your profits as long as you are above the drawdown and follow the consistency rules.

- Low Entry Barrier: The $27 Starter plan lowers the entry cost for traders who want to test funded conditions with limited capital exposure.

Blue Guardian Crypto Challenge Account

Blue Guardian offers a dedicated Crypto Challenge Account built specifically for the high-volatility nature of digital asset markets. These accounts use adjusted leverage and clearly defined drawdown limits to help traders manage risk more effectively, especially during sudden price spikes and rapid market movements commonly seen in crypto trading.

Below is a quick overview of Blue Guardian Crypto challenge account rules to pass the evaluation:

| Account Size | Account Fee | Profit Target (10%) | Max Daily Drawdown (3%) | Max Total Drawdown (6% - 10%) |

|---|---|---|---|---|

| $5,000 | $70 | $500 | $150 | $300 |

| $10,000 | $87 | $1,000 | $300 | $600 |

| $25,000 | $87 | $2,500 | $750 | $1,500 |

| $50,000 | $277 | $5,000 | $1,500 | $3,000 |

| $100,000 | $277 | $10,000 | $3,000 | $6,000 |

Why Choose Crypto Account Type?

- Crypto-Specific Leverage: 1:2 leverage stops the crypto-trader's weekend losses from reaching the whole account balance.

- 24/7 Market Access: Trade major coins like BTC, ETH and SOL even when traditional Forex markets are closed.

- Spread-Based Trading: Many crypto instruments with $0 commissions, enable traders to keep a higher percentage of their profits.

Blue Guardian’s Guardian X Challenge (One Phase)

The Guardian X Challenge is an unique limited time funding model that runs for up to 72 hours, giving traders a short window to qualify under special conditions. It is a randomly released weekend challenge that follows a one-phase evaluation structure. The Guardian X challenge offers traders a faster route to a funded account by meeting only a 3% profit target. One key advantage is the streamlined structure that begins as soon as your first trade is placed, but a notable risk is the strict 3% daily drawdown limit that can make volatile trading difficult. This challenge features a relatively low maximum drawdown of 5%, helping traders lock in their risk early, but traders should be aware that slightly exceeding these limits leads to automatic disqualification from the challenge.

Below is a simplified breakdown of Blue Guardian’s Guardian X Challenge rules to pass evaluation:

| Account Size | Account Fee | Profit Target (3%) | Max Daily Drawdown (3%) | Max Total Drawdown (5%) |

| $5,000 | $92 | $150 | $150 | $250 |

| $10,000 | $126 | $300 | $300 | $500 |

| $25,000 | $262 | $750 | $750 | $1,250 |

| $50,000 | $407 | $1,500 | $1,500 | $2,500 |

| $100,000 | $662 | $3,000 | $3,000 | $5,000 |

Why Choose Guardian X Challenge?

- Fast results: With only one phase and a low profit target, traders can qualify more quickly than multi-phase challenges.

- Risk-aware trading: A defined daily and total drawdown helps enforce disciplined risk management strategies.

- Suitable for short-term strategies: Traders comfortable with quick trade execution and consistency-based approaches can benefit most from the challenge’s design.

Our Review on Blue Guardian Account Types

Blue Guardian offers multiple account models covering structured evaluation, instant funding, unique Guardian X Challenge model and crypto focused trading. Deciding what features to highlight can be quite tricky because each trader will have different needs and preferences. Based on our analysis, the Blue Guardian Pro challenges for 1-step and 2-step evaluations are probably the most notable structural feature that removes one of the most common irritants for traders with high-probability systems. That is “minimum trading days”, an obstacle they might have to face quite often when they hit the target quickly. The $27 Instant Starter addition reduces entry cost and may appeal to traders testing funded conditions for the first time.

Overall, the no time limit challenge models with balanced trading rules creates a prop firm funding structure that may suit disciplined traders in 2026.

Blue Guardian Drawdown Rules and News Trading Regulations

In this section of our prop firm review 2026, we break down the Blue Guardian drawdown rules and news trading rules so traders can clearly understand how the daily drawdown calculations is done and account breach conditions before attempting start trading in a funded account.

Drawdown Details

Blue Guardian has two different drawdown structures depending on your account type. For Challenge Accounts, the firm uses a Static Drawdown calculated on the opening balance which provides a transparent buffer. Whereas, the Instant Funding and Pro models are based on a Trailing Drawdown that follows your highest recorded equity.

The 4% daily drawdown is calculated based on the starting days balance or equity - whichever is higher. The Max Total Drawdown can either be static (fixed at the start) or trailing (locks in at your peak equity).

Example:

For a $100,000 Standard Challenge account where an 8% static max drawdown is allowed, your account is said to be under a breach if your equity goes below $92,000. Even if you increase the account to $105,000, the level at which you are under a breach remains at $92,000. On an Instant Account with a 6% trailing drawdown, if your equity goes to $105,000, the new breach level that trails up to $98,700.

Most Common Trader Mistake:

Many traders do not remember that on trailing accounts, the drawdown is not lowered if a trade results in a loss. Profit not being locked in or over-leveraging after a winning streak are the main reasons of accidental daily drawdown violations.

News Trading Rules

In this section of our Blue Guardian review 2026, we examine the firm’s news trading rules across different account models. Understanding whether trading during high impact news events are allowed, restricted or prohibited is important as volatility during economic releases can directly impact a trader’s daily drawdown and overall account risk.

Blue Guardian applies different news trading rules depending on the selected account type:

- Challenge Accounts & Instant Pro Accounts: Traders are permitted to open, close, and hold trades during high-impact news events such as NFP or FOMC releases. There are no time-window restrictions under these models.

- Instant Standard Accounts: News trading is not fully banned; however, traders are restricted from opening or closing trades within a 2-minute window before and after high-impact economic releases. Existing trades held outside that window remain valid.

Important Risk Consideration

Even where news trading is allowed - traders should remain aware that spread widening and slippage during volatile events can increase the probability of breaching daily drawdown limits. The most common mistake is over-leveraging immediately before a major announcement without accounting for temporary liquidity gaps. Therefore, traders are advised to use the

Guardian Shield to automate equity protection.

Overall, Blue Guardian’s news trading rules are flexible on most account types but traders must align their trading strategy with the specific restrictions of their selected Blue Guardian funding model in order to remain compliant with funded account conditions.

Trading Platforms and Instruments Access by Blue Guardian

Based on verified, official information from Blue Guardian, the firm provides a versatile range of liquid assets designed to suit diverse trading strategies. Blue Guardian supports trading on MetaTrader 5 (MT5), TradeLocker and Match-Trader platforms, giving traders flexibility in execution and platform preference. Traders can access global markets through high-leverage environments, ensuring that whether you are a scalper, day trader or swing trader, there is an asset class that fits your system. By offering a mix of traditional and digital assets, Blue Guardian enables users to diversify their portfolios and capitalize on market volatility across different time zones.

Trading Instruments:

- Forex: More than 50 pairs of major, minor and exotic.

- Indices: World's leading indices such as US30, NDX100 and GER40.

- Commodities: Gold (XAUUSD), Silver, Oil and Natural Gas.

- Crypto: Biggest tokens like BTC, ETH, SOL and XRP (trading is available around the clock).

Note: Instrument availability may vary depending on the selected account type and trading platform.

The inclusion of a dedicated Crypto Challenge highlights Blue Guardian's commitment to modern asset classes, offering tailored leverage specifically for digital currencies. This variety ensures that traders are not limited to a single market, allowing for better risk distribution and the ability to find opportunities even when certain markets are stagnant. For those looking to maximize their 80% to 90% profit split, selecting the right instrument with the appropriate volatility is key to long-term success in 2026.

Blue Guardian Spreads & Commissions - What You Really Pay

Understanding execution costs is essential, especially for day traders and scalpers where small price differences can significantly impact long-term performance. Blue Guardian operates its own server infrastructure to deliver institutional-grade liquidity and pricing.

Spreads and Commissions Details

On major Forex pairs such as EUR/USD, spreads can be as low as 0.0 pips under normal market conditions. A commission of $5 per lot is charged on Forex and Commodities, whereas Stock, Indices and Cryptocurrencies are structured as spread-only instruments, meaning no separate commission is applied.

While tight spreads may benefit traders using high-frequency strategies, trader must also onsider that spreads an widen during volatile market conditions – particularly around major news events. Overall, Blue Guardian’s pricing model seem to be competitive for multi-asset trader but total trading costs will ultimately depend on execution quality, market conditions and trading frequency.

Blue Guardian Trading Rules (2026)

In 2026, understanding the Blue Guardian trading rules is essential for maintaining your funded account and maximizing profit splits. Blue Guardian prop firm is known for its flexibility, particularly regarding news trading and lack of time limits. But success requires a firm grasp of their specific drawdown limits. By knowing these specific rules, traders can better align their strategies with Blue Guardian's risk limits to ensure long-term account sustainability.

| Trading Strategy | Allowed? | Details |

| Scalping | Yes | No restrictions on holding time. |

| Hedging | Yes | Allowed within the same account. |

| EAs/Bots | Yes | Must be unique and – HFT is banned. |

| News Trading | Yes | Fully permitted on all challenge and instant accounts, except for the Instant Standard account. |

| Weekend / Overnight Holding | Yes | Traders can hold positions overnight or the weekend on all account types. |

| Copy Trading | Yes | Allowed from your own accounts - copying other trader’s signals or external services is restricted. |

| HFT (High-Frequency Trading) | No | Strictly prohibited as it exploits latency and does not reflect real market conditions |

| Martingale | No | Opening multiple positions in the same direction while in drawdown (averaging down) is prohibited. |

Prohibited Practices at Blue Guardian

To maintain a fair trading environment and ensure long-term sustainability, Blue Guardian prohibits specific high-risk behaviors. Below are the details of other trading strategies and activity restrictions:

- HFT (High-Frequency Trading): Using bots that execute hundreds of trades in seconds to game the evaluation.

- Arbitrage Trading: Exploiting price delays between different brokers (Latency or Reverse Arbitrage).

- Account Sharing: You cannot have someone else trade for you or use pass-your-challenge services.

- Extreme Martingale: Doubling down on losing trades in a way that creates a gambling risk profile.

- Copy Trading Between Users: You can copy your own trades from your personal account, but you cannot copy trades from other Blue Guardian users.

Soft vs. Hard Breach

It is vital to know the difference between a mistake and an account-terminating activity as Blue Guardian has set few soft breaches and hard breahes.

Soft Breach:

- This is a minor rule violation that doesn't necessarily close your account but might stop a specific trade.

- Example, Attempting to trade news on an Instant Standard account where it is restricted. The trade may be voided, but you keep the account.

Hard Breach:

- This is a violation of the core risk rules that results in the immediate loss of the account. If the trading closed in 2 minutes, then it may be flagged for tick scalping.

- Example, If your account equity drops below the 4% Daily Drawdown limit, the account is automatically disabled.

IP Address Security

The firm monitors IP consistency to prevent account sharing violations. Traders using VPS services should ensure they comply with the firm’s policies.

Scaling Plan at Blue Guardian

Blue Guardian offers a structured scaling path to increase your funded trading capital. This prop firm scaling plan rewards consistent performance, allowing successful traders to reach a maximum allocation of $4,000,000.

Scaling Plan Details:

To be eligible a trader has to make a total profit of at least 10% within a time frame of 4 consecutive months out of which at least two months must be profitable. On fulfilling these conditions, Blue Guardian will raise the account value by adding 25% of the initial capital. Apart from that, the standard 80% profit split can be increased up to 90%.

This scaling model ensures that disciplined traders can access higher capital tiers. By focusing on steady gains, Blue Guardian provides a sustainable environment for long-term professional growth.

Payment Methods & Payout Process at Blue Guardian

Blue Guardian prop firm provides a streamlined infrastructure for funding and payout to global traders who value secure transactions and verified, fast payout cycles. The Blue Guardian account fee payment and payouts are available via regulated payment gateways and diverse profit withdrawal options.

Payout Timeline at Blue Guardian

On its official website, Blue Guardian advertises a 24-hour payout guarantee on eligible funded accounts.

Example: If you submit a payout request on a Monday at 10:00 AM, your funds are typically processed and sent by Tuesday at 10:00 AM. According to the firm’s stated policy, if the 24-hour window is missed, the trader may receive an adjusted profit split as compensation.

Supported Payment Methods at Blue Guardian

To purchase a challenge or an instant funding account, you can use:

- Credit/Debit Cards: Major providers like Visa and Mastercard.

- Cryptocurrency: Support for BTC, ETH, LTC, USDC and USDT.

Supported Payout Options at Blue Guardian

When you are ready to withdraw your profits, Blue Guardian provides:

- Bank Transfers: Facilitated through reliable platforms like Rise or Deel.

- Cryptocurrency: Direct transfers to your digital wallet for faster global access.

How the Payout Process Works

- Eligibility: For most accounts, you become eligible for your first payout 14 days after placing your first trade. You can reduce this to 7 days by selecting the weekly payouts via add-on.

- Request: Once eligible, navigate to your trader dashboard and click the payout request button.

- Verification: The system automatically checks that all trades are closed and that no consistency or drawdown rules were violated.

- Processing: Blue Guardian processes the payout request within 24 hours. While for Instant accounts the firm provides on-demand payouts. For all Blue Guardian account type traders first have to fulfil the payout eligibility conditions in order to recieve their profit withdrawals.

Our Verdict on Blue Guardian Payouts

Based on our analysis, Blue Guardian prop firm maintains a competitive edge by integrating Rise and Crypto options, which are currently the industry standards for smooth and reliable payouts. The rules are clear and process is transparent, though traders must stay mindful of the 14-day default buffer. While the standard timeline is fair, the option to shorten the payout cycle via an add-on is a practical feature for those who prioritize frequent cash flow.

Countries Restricted at Blue Guardian

Blue Guardian gives access to traders from most countries, yet a few jurisdictions are restricted due to regulatory requirements or local laws. Here are the list of restricted countries from where the traders cannot purchase Blue Guardian funded trading accounts.

Restricted Countries:

- Afghanistan

- North Korea

- Iran

- Syria

- Myanmar

- Japan (For certain products)

- Singapore (For certain products)

Traders must note that, country restrictions may change due to regulatory or payment provider requirements.

If you live in one of these regions, it is a good idea to check the official Blue Guardian website or contact their support team for the most recent updates. Staying informed about these rules helps you choose the right funding path without any unexpected legal or payment delays.

Our Final Verdict on Blue Guardian

Based on our research and analysis, Blue Guardian is a versatile prop firm that balances structural variety with transparent rules. It is ideal for disciplined day and swing traders who value the absence of time limits and the efficiency of “Pro” models with no minimum trading days. While daily drawdown limits are relatively strict, the refundable fees and low-entry $27 Starter account offer significant value. Moreover, this firm might be a good choice for consistent traders seeking a reputable funding prop firm without hidden operational rules.

View the latest pricing and verified prop firm offers, reviewed by The Trusted Prop.